Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 13.1% in the 2.5 months of 2019 (including dividend payments). Conversely, hedge funds’ 15 preferred S&P 500 stocks generated a return of 19.7% during the same period, with 93% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Banc of California, Inc. (NYSE:BANC).

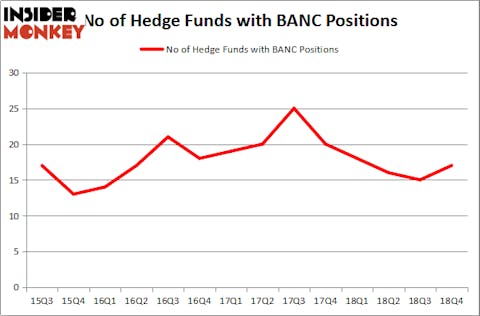

Banc of California, Inc. (NYSE:BANC) investors should be aware of an increase in activity from the world’s largest hedge funds recently. BANC was in 17 hedge funds’ portfolios at the end of December. There were 15 hedge funds in our database with BANC positions at the end of the previous quarter. Our calculations also showed that BANC isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the key hedge fund action regarding Banc of California, Inc. (NYSE:BANC).

Hedge fund activity in Banc of California, Inc. (NYSE:BANC)

Heading into the first quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the second quarter of 2018. By comparison, 18 hedge funds held shares or bullish call options in BANC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Emanuel J. Friedman’s EJF Capital has the most valuable position in Banc of California, Inc. (NYSE:BANC), worth close to $27.3 million, accounting for 3.2% of its total 13F portfolio. The second largest stake is held by Michael Price of MFP Investors, with a $17.2 million position; the fund has 2.3% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism encompass Tom Brown’s Second Curve Capital, Mark Lee’s Forest Hill Capital and Jeffrey Hinkle’s Shoals Capital Management.

Consequently, some big names were breaking ground themselves. Shoals Capital Management, managed by Jeffrey Hinkle, created the largest position in Banc of California, Inc. (NYSE:BANC). Shoals Capital Management had $7.7 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $0.4 million position during the quarter. The other funds with new positions in the stock are Michael Platt and William Reeves’s BlueCrest Capital Mgmt. and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Banc of California, Inc. (NYSE:BANC). We will take a look at Select Energy Services, Inc. (NYSE:WTTR), Avon Products, Inc. (NYSE:AVP), SP Plus Corp (NASDAQ:SP), and Ituran Location and Control Ltd. (US) (NASDAQ:ITRN). All of these stocks’ market caps are similar to BANC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WTTR | 12 | 57230 | -2 |

| AVP | 24 | 129120 | -2 |

| SP | 12 | 90100 | 0 |

| ITRN | 9 | 106305 | -1 |

| Average | 14.25 | 95689 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $96 million. That figure was $93 million in BANC’s case. Avon Products, Inc. (NYSE:AVP) is the most popular stock in this table. On the other hand Ituran Location and Control Ltd. (US) (NASDAQ:ITRN) is the least popular one with only 9 bullish hedge fund positions. Banc of California, Inc. (NYSE:BANC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BANC wasn’t nearly as popular as these 15 stock and hedge funds that were betting on BANC were disappointed as the stock returned 10.5% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.