After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Guidewire Software Inc (NYSE:GWRE).

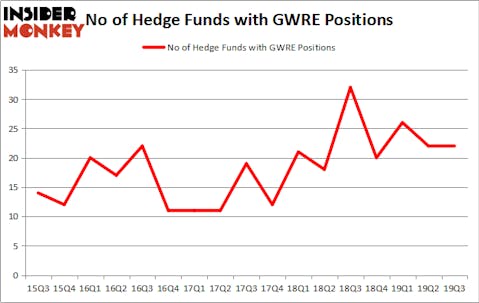

Guidewire Software Inc (NYSE:GWRE) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 22 hedge funds’ portfolios at the end of the third quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Cypress Semiconductor Corporation (NASDAQ:CY), Juniper Networks, Inc. (NYSE:JNPR), and RenaissanceRe Holdings Ltd. (NYSE:RNR) to gather more data points. Our calculations also showed that GWRE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Daniel Sundheim of D1 Capital Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the key hedge fund action surrounding Guidewire Software Inc (NYSE:GWRE).

What does smart money think about Guidewire Software Inc (NYSE:GWRE)?

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in GWRE over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Guidewire Software Inc (NYSE:GWRE) was held by D1 Capital Partners, which reported holding $303 million worth of stock at the end of September. It was followed by Stockbridge Partners with a $261.6 million position. Other investors bullish on the company included Cadian Capital, Shannon River Fund Management, and Skye Global Management. In terms of the portfolio weights assigned to each position Stockbridge Partners allocated the biggest weight to Guidewire Software Inc (NYSE:GWRE), around 10.38% of its 13F portfolio. Shannon River Fund Management is also relatively very bullish on the stock, designating 8.68 percent of its 13F equity portfolio to GWRE.

Due to the fact that Guidewire Software Inc (NYSE:GWRE) has faced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of money managers who were dropping their full holdings in the third quarter. Interestingly, Marcelo Desio’s Lucha Capital Management cut the largest stake of all the hedgies tracked by Insider Monkey, totaling close to $13.8 million in stock. Donald Sussman’s fund, Paloma Partners, also sold off its stock, about $7.9 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Guidewire Software Inc (NYSE:GWRE) but similarly valued. These stocks are Cypress Semiconductor Corporation (NASDAQ:CY), Juniper Networks, Inc. (NYSE:JNPR), RenaissanceRe Holdings Ltd. (NYSE:RNR), and Spirit AeroSystems Holdings, Inc. (NYSE:SPR). This group of stocks’ market values match GWRE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CY | 34 | 1456562 | -2 |

| JNPR | 30 | 637184 | 2 |

| RNR | 17 | 657683 | -3 |

| SPR | 36 | 2062498 | 5 |

| Average | 29.25 | 1203482 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $1203 million. That figure was $837 million in GWRE’s case. Spirit AeroSystems Holdings, Inc. (NYSE:SPR) is the most popular stock in this table. On the other hand RenaissanceRe Holdings Ltd. (NYSE:RNR) is the least popular one with only 17 bullish hedge fund positions. Guidewire Software Inc (NYSE:GWRE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on GWRE as the stock returned 15.6% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.