Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the elite funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of General Dynamics Corporation (NYSE:GD).

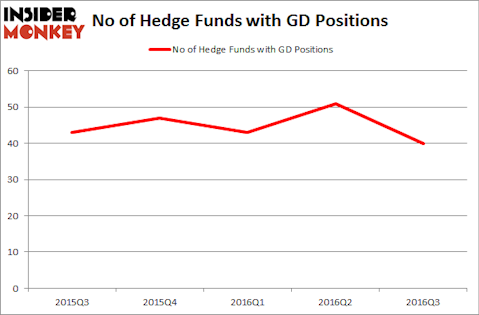

Is General Dynamics Corporation (NYSE:GD) a splendid investment today? The best stock pickers are in a pessimistic mood. The number of long hedge fund bets shrunk by 11 in recent months. GD was in 40 hedge funds’ portfolios at the end of the third quarter of 2016. There were 51 hedge funds in our database with GD holdings at the end of the previous quarter. At the end of this article we will also compare GD to other stocks including General Mills, Inc. (NYSE:GIS), McKesson Corporation (NYSE:MCK), and Automatic Data Processing (NASDAQ:ADP) to get a better sense of its popularity.

Follow General Dynamics Corp (NYSE:GD)

Follow General Dynamics Corp (NYSE:GD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Philip Pilosian / Shutterstock.com

With all of this in mind, we’re going to analyze the new action surrounding General Dynamics Corporation (NYSE:GD).

Hedge fund activity in General Dynamics Corporation (NYSE:GD)

At Q3’s end, a total of 40 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -22% from the previous quarter. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, James A. Star’s Longview Asset Management has the most valuable position in General Dynamics Corporation (NYSE:GD), worth close to $5.171 billion, amounting to 89% of its total 13F portfolio. The second largest stake is held by David Cohen and Harold Levy of Iridian Asset Management, with a $428.6 million position; the fund has 3.7% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish consist of Cliff Asness’ AQR Capital Management, Dan Loeb’s Third Point and Ken Griffin’s Citadel Investment Group.