Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The one and a half month time period since the end of the third quarter is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Choice Hotels International, Inc. (NYSE:CHH).

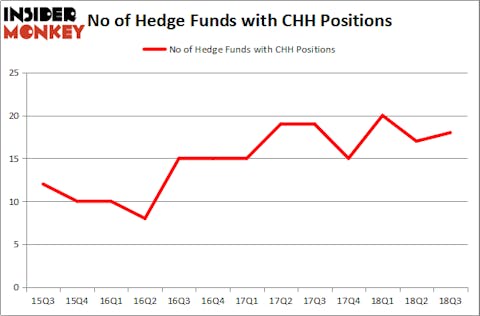

Choice Hotels International, Inc. (NYSE:CHH) was in 18 hedge funds’ portfolios at the end of September. CHH has actually experienced a slight increase in activity from the world’s largest hedge funds recently, as there were 17 hedge funds in our database with CHH positions at the end of the previous quarter. While the stock is lowly building its net of long investors, it has not succeeded to intrigue many billionaires (to see which stocks are most popular with the wealthy elite, take a look at the list of 30 stocks billionaires are crazy about: Insider Monkey billionaire stock index). These stats about Choice Hotels International, Inc. (NYSE:CHH) are insufficient for us to make a conclusion if the stock is worth buying. Hence, we need to continue with our analysis.

To most stock holders, hedge funds are viewed as slow, outdated financial tools of the past. While there are over 8000 funds with their doors open at present, Our researchers look at the leaders of this group, approximately 700 funds. These money managers handle bulk of the hedge fund industry’s total capital, and by tailing their inimitable stock picks, Insider Monkey has deciphered a few investment strategies that have historically beaten the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

How have hedgies been trading Choice Hotels International, Inc. (NYSE:CHH)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in CHH over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Choice Hotels International, Inc. (NYSE:CHH), with a stake worth $104.8 million reported as of the end of September. Trailing Renaissance Technologies was Echo Street Capital Management, which amassed a stake valued at $101.3 million. Arrowstreet Capital, GLG Partners, and Markel Gayner Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key hedge funds have jumped into Choice Hotels International, Inc. (NYSE:CHH) headfirst. Gotham Asset Management, managed by Joel Greenblatt, assembled the most valuable position in Choice Hotels International, Inc. (NYSE:CHH). Gotham Asset Management had $5.3 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $1.3 million investment in the stock during the quarter. The following funds were also among the new CHH investors: Bruce Kovner’s Caxton Associates LP, Paul Tudor Jones’s Tudor Investment Corp, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Choice Hotels International, Inc. (NYSE:CHH) but similarly valued. These stocks are Cinemark Holdings, Inc. (NYSE:CNK), ARRIS International plc (NASDAQ:ARRS), Pinnacle Financial Partners, Inc. (NASDAQ:PNFP), and Green Dot Corporation (NYSE:GDOT). This group of stocks’ market values match CHH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNK | 19 | 248506 | 4 |

| ARRS | 23 | 645342 | -2 |

| PNFP | 13 | 130971 | 3 |

| GDOT | 20 | 320437 | -1 |

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $336 million. That figure was $277 million in CHH’s case. ARRIS International plc (NASDAQ:ARRS) is the most popular stock in this table. On the other hand Pinnacle Financial Partners, Inc. (NASDAQ:PNFP) is the least popular one with only 13 bullish hedge fund positions. Choice Hotels International, Inc. (NYSE:CHH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ARRS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.