As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and recouped their losses by the end of the first quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about bluebird bio Inc (NASDAQ:BLUE).

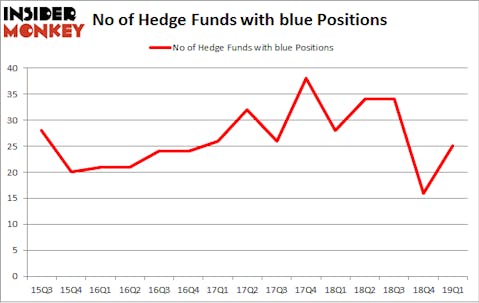

bluebird bio Inc (NASDAQ:BLUE) has seen an increase in hedge fund sentiment lately. Our calculations also showed that blue isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a lot of formulas shareholders can use to size up stocks. A couple of the less utilized formulas are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can beat the market by a solid amount (see the details here).

We’re going to take a look at the key hedge fund action surrounding bluebird bio Inc (NASDAQ:BLUE).

What have hedge funds been doing with bluebird bio Inc (NASDAQ:BLUE)?

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 56% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards BLUE over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Casdin Capital was the largest shareholder of bluebird bio Inc (NASDAQ:BLUE), with a stake worth $56.2 million reported as of the end of March. Trailing Casdin Capital was Healthcor Management LP, which amassed a stake valued at $47.7 million. D E Shaw, Millennium Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. Healthcor Management LP, managed by Arthur B Cohen and Joseph Healey, established the largest position in bluebird bio Inc (NASDAQ:BLUE). Healthcor Management LP had $47.7 million invested in the company at the end of the quarter. Steven Boyd’s Armistice Capital also initiated a $10.7 million position during the quarter. The other funds with brand new BLUE positions are Paul Marshall and Ian Wace’s Marshall Wace LLP, Israel Englander’s Millennium Management, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as bluebird bio Inc (NASDAQ:BLUE) but similarly valued. These stocks are Coty Inc (NYSE:COTY), Huntington Ingalls Industries Inc (NYSE:HII), OGE Energy Corp. (NYSE:OGE), and American Financial Group, Inc. (NYSE:AFG). All of these stocks’ market caps are closest to BLUE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COTY | 24 | 688610 | 5 |

| HII | 31 | 708221 | 4 |

| OGE | 17 | 265837 | 1 |

| AFG | 30 | 316813 | 1 |

| Average | 25.5 | 494870 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $495 million. That figure was $190 million in BLUE’s case. Huntington Ingalls Industries Inc (NYSE:HII) is the most popular stock in this table. On the other hand OGE Energy Corp. (NYSE:OGE) is the least popular one with only 17 bullish hedge fund positions. bluebird bio Inc (NASDAQ:BLUE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately BLUE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); BLUE investors were disappointed as the stock returned -23.4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.