2018’s fourth quarter was a rough one for investors and many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 41.3% in 2019 and outperformed the S&P 500 ETF by more than 10 percentage points. In this article we will study how hedge fund sentiment towards Insulet Corporation (NASDAQ:PODD) changed during the third quarter and how the stock performed in comparison to hedge fund consensus stocks.

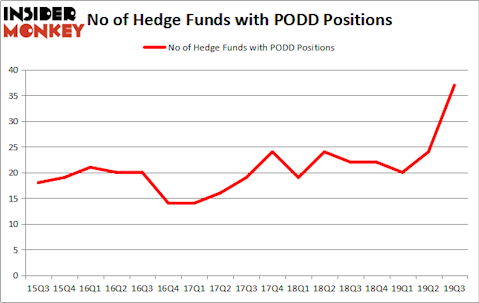

Insulet Corporation (NASDAQ:PODD) was in 37 hedge funds’ portfolios at the end of September. PODD investors should be aware of an increase in support from the world’s most elite money managers of late. There were 24 hedge funds in our database with PODD positions at the end of the second quarter. Our calculations also showed that PODD isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

According to most stock holders, hedge funds are assumed to be worthless, old financial tools of years past. While there are over 8000 funds in operation at the moment, Our researchers choose to focus on the crème de la crème of this club, approximately 750 funds. Most estimates calculate that this group of people manage the lion’s share of all hedge funds’ total asset base, and by observing their first-class picks, Insider Monkey has spotted a number of investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Kris Jenner of Rock Springs Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now let’s take a look at the fresh hedge fund action surrounding Insulet Corporation (NASDAQ:PODD).

What does smart money think about Insulet Corporation (NASDAQ:PODD)?

Heading into the fourth quarter of 2019, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of 54% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PODD over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Insulet Corporation (NASDAQ:PODD) was held by Coatue Management, which reported holding $116.7 million worth of stock at the end of September. It was followed by D E Shaw with a $89.5 million position. Other investors bullish on the company included Millennium Management, Rock Springs Capital Management, and Columbus Circle Investors. In terms of the portfolio weights assigned to each position Think Investments allocated the biggest weight to Insulet Corporation (NASDAQ:PODD), around 11.19% of its 13F portfolio. Consonance Capital Management is also relatively very bullish on the stock, designating 2.54 percent of its 13F equity portfolio to PODD.

As industrywide interest jumped, some big names were breaking ground themselves. Coatue Management, managed by Philippe Laffont, created the largest position in Insulet Corporation (NASDAQ:PODD). Coatue Management had $116.7 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $44.5 million position during the quarter. The following funds were also among the new PODD investors: Mitchell Blutt’s Consonance Capital Management, Brian Ashford-Russell and Tim Woolley’s Polar Capital, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s check out hedge fund activity in other stocks similar to Insulet Corporation (NASDAQ:PODD). We will take a look at Altaba Inc. (NASDAQ:AABA), Eastman Chemical Company (NYSE:EMN), Domino’s Pizza, Inc. (NYSE:DPZ), and Weibo Corp (NASDAQ:WB). This group of stocks’ market caps match PODD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AABA | 48 | 4699502 | -11 |

| EMN | 27 | 409073 | 4 |

| DPZ | 36 | 1932455 | 9 |

| WB | 14 | 353314 | -2 |

| Average | 31.25 | 1848586 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $1849 million. That figure was $500 million in PODD’s case. Altaba Inc. (NASDAQ:AABA) is the most popular stock in this table. On the other hand Weibo Corp (NASDAQ:WB) is the least popular one with only 14 bullish hedge fund positions. Insulet Corporation (NASDAQ:PODD) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on PODD as the stock returned 115.8% in 2019 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.