World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

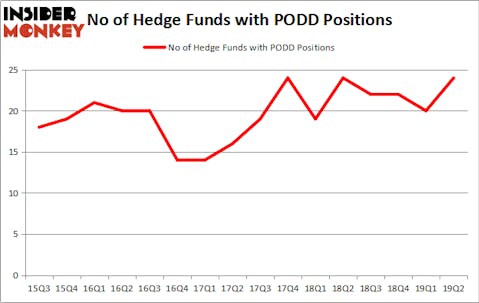

Is Insulet Corporation (NASDAQ:PODD) a buy here? Hedge funds are becoming more confident. The number of long hedge fund bets inched up by 4 lately. Our calculations also showed that PODD isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are tons of methods investors have at their disposal to grade their holdings. A pair of the best methods are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the top money managers can beat the market by a significant margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the key hedge fund action regarding Insulet Corporation (NASDAQ:PODD).

How have hedgies been trading Insulet Corporation (NASDAQ:PODD)?

At Q2’s end, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from one quarter earlier. On the other hand, there were a total of 24 hedge funds with a bullish position in PODD a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Insulet Corporation (NASDAQ:PODD) was held by D E Shaw, which reported holding $96.3 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $73 million position. Other investors bullish on the company included Deerfield Management, Think Investments, and Rock Springs Capital Management.

As one would reasonably expect, some big names were leading the bulls’ herd. Deerfield Management, managed by James E. Flynn, assembled the most valuable position in Insulet Corporation (NASDAQ:PODD). Deerfield Management had $52.1 million invested in the company at the end of the quarter. Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management also initiated a $29.2 million position during the quarter. The other funds with brand new PODD positions are Renaissance Technologies, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Phill Gross and Robert Atchinson’s Adage Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Insulet Corporation (NASDAQ:PODD) but similarly valued. We will take a look at Berry Global Group Inc (NYSE:BERY), Douglas Emmett, Inc. (NYSE:DEI), AerCap Holdings N.V. (NYSE:AER), and Planet Fitness Inc (NYSE:PLNT). All of these stocks’ market caps are similar to PODD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BERY | 40 | 2294462 | 0 |

| DEI | 19 | 627313 | 5 |

| AER | 27 | 805285 | 4 |

| PLNT | 38 | 661398 | 13 |

| Average | 31 | 1097115 | 5.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $1097 million. That figure was $391 million in PODD’s case. Berry Global Group Inc (NYSE:BERY) is the most popular stock in this table. On the other hand Douglas Emmett, Inc. (NYSE:DEI) is the least popular one with only 19 bullish hedge fund positions. Insulet Corporation (NASDAQ:PODD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on PODD as the stock returned 38.2% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.