Does IAC/InterActiveCorp (NASDAQ:IAC) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and invest millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

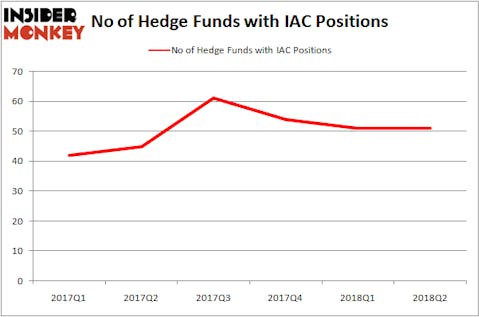

Hedge funds are quite bullish on IAC/InterActiveCorp (NASDAQ:IAC), owning 20.8% of its shares, although there wasn’t much overall activity in the stock during Q2, as hedge fund ownership remained flat at 51. It also ranked as one of the 25 Stocks Billionaires Are Piling On, being owned by such hedge fund heavyweights as Israel Englander’s Millennium Management (857,052 shares) and Ken Griffin’s Citadel Investment Group (603,352 shares). Maran Capital also likes IAC, noting in its 2018 Q1 investor letter that it’s using an arbitrage strategy of being long IAC, while shorting its publicly traded holdings Match Group, Inc. (NASDAQ:MTCH) and ANGI Homeservices Inc. (NASDAQ:ANGI). All three stocks have performed extremely well this year.

To the average investor there are plenty of tools that can be put to use to value their holdings. Two of the less utilized tools are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the best money managers can outpace the S&P 500 by a solid amount (see the details here).

Let’s analyze the key hedge fund action regarding IAC/InterActiveCorp (NASDAQ:IAC).

How are hedge funds trading IAC/InterActiveCorp (NASDAQ:IAC)?

At Q3’s end, a total of 51 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from one quarter earlier. By comparison, 54 hedge funds held shares or bullish call options in IAC heading into this year. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Christian Leone’s Luxor Capital Group held the most valuable stake in IAC/InterActiveCorp (NASDAQ:IAC), which was worth $337.3 million at the end of the second quarter. On the second spot was AQR Capital Management which had amassed a $317.4 million position. Moreover, Marcato Capital Management, Cadian Capital, and Becker Drapkin Management were also bullish on IAC/InterActiveCorp (NASDAQ:IAC), allocating a large percentage of their 13F portfolios to this stock.

On the other hand, Thomas Steyer’s Farallon Capital cut the largest IAC stake during Q2 of the 700 funds watched by Insider Monkey, comprising about $111.8 million in stock. Michael Kaine’s Numina Capital was right behind this move, as the fund cut about $57 million worth of shares.

Let’s now take a look at hedge fund activity in other stocks similar to IAC/InterActiveCorp (NASDAQ:IAC). These stocks are Cenovus Energy Inc (USA) (NYSE:CVE), Synopsys, Inc. (NASDAQ:SNPS), Icahn Enterprises LP (NASDAQ:IEP), and Sociedad Quimica y Minera (ADR) (NYSE:SQM). This group of stocks’ market valuations are similar to IAC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVE | 22 | 635646 | 4 |

| SNPS | 28 | 841045 | 1 |

| IEP | 3 | 11986922 | -2 |

| SQM | 15 | 136326 | 5 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $3.40 billion. That figure was $2.66 billion in IAC’s case. Synopsys, Inc. (NASDAQ:SNPS) is the most popular stock in this table. On the other hand Icahn Enterprises LP (NASDAQ:IEP) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks IAC/InterActiveCorp (NASDAQ:IAC) is more popular among hedge funds. Considering that hedge funds and billionaires are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.