Shannon River Fund Management, LLC is a New York City-based investment firm managed by Spencer M. Waxman. Shannon River’s equity portfolio is worth over $399.91 million, according to the fund’s last 13F filing with the SEC. In the third quarter, the fund returned 18.12%, according to our calculations that took into account only the fund’s long positions in companies worth over $1.0 billion.

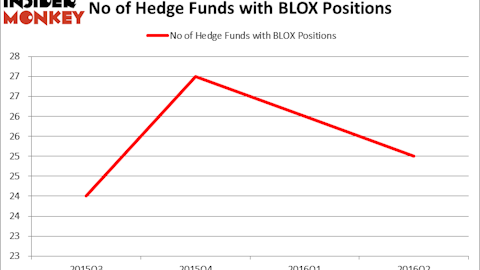

Investors are growing bearish on the hedge fund industry due to high fees, insider trading and losses. But paying attention to the correct data points could reveal an interesting trend in smart money investment firms. Hedge funds tracked by Insider Monkey delivered an average return of 8.3% during the third quarter, beating S&P 500 ETFs which returned only 3.3%. But here the catch: these hedge funds returns are from long side of positions in companies which have a market capitalization of $1 billion or more. Our research stretching across years has shown that betting on hedge funds’ long positions is generally fruitful.

Let’s delve deeper and see how Shannon River was positioned in its top four picks in the second quarter.

Shannon River Fund boosted its position in IAC/InterActiveCorp (NASDAQ:IAC) by 237% in the second quarter, ending June with a stake containing 740,000 shares valued at $41.66 million. The stock advanced by 11% during the third quarter. At the end of the second quarter, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from one quarter earlier. Among these funds, Highfields Capital Management held the most valuable stake in IAC/InterActiveCorp (NASDAQ:IACI), which was worth $313.8 million at the end of the second quarter. On the second spot was Cadian Capital which amassed $125.9 million worth of shares. Moreover, Luxor Capital Group, AQR Capital Management, and Cardinal Capital were also bullish on IAC/InterActiveCorp (NASDAQ:IACI).

Follow Match Group Inc. (NASDAQ:MTCH)

Follow Match Group Inc. (NASDAQ:MTCH)

Receive real-time insider trading and news alerts

Shannon River reported ownership of 855,000 shares of Take-Two Interactive Software, Inc. (NASDAQ:TTWO) worth $32.42 million as of the end of the second quarter. The stock rewarded its investors with gains of 18.9% in the third quarter. A total of 47 investors tracked by Insider Monkey held long positions in this stock, a change of 12% from the previous quarter. More specifically, Eminence Capital was the largest shareholder of Take-Two Interactive Software, Inc. (NASDAQ:TTWO), with a stake worth $144.2 million reported as of the end of June. Trailing Eminence Capital was Greenlight Capital, which amassed a stake valued at $103.7 million. Renaissance Technologies, Citadel Investment Group, and Ivory Capital (Investment Mgmt) also held valuable positions in Take-Two Interactive Software, Inc. (NASDAQ:TTWO).

Follow Take Two Interactive Software Inc (NASDAQ:TTWO)

Follow Take Two Interactive Software Inc (NASDAQ:TTWO)

Receive real-time insider trading and news alerts