Is Taylor Morrison Home Corp (NYSE:TMHC) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

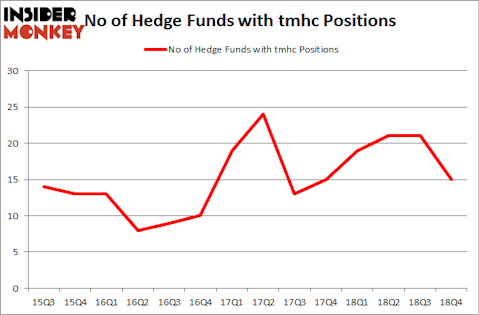

Taylor Morrison Home Corp (NYSE:TMHC) has experienced a decrease in support from the world’s most elite money managers recently. Our calculations also showed that tmhc isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most market participants, hedge funds are assumed to be unimportant, outdated investment vehicles of yesteryear. While there are greater than 8000 funds in operation at the moment, Our researchers hone in on the crème de la crème of this club, around 750 funds. It is estimated that this group of investors control most of the hedge fund industry’s total capital, and by keeping an eye on their inimitable investments, Insider Monkey has identified numerous investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to check out the fresh hedge fund action regarding Taylor Morrison Home Corp (NYSE:TMHC).

How are hedge funds trading Taylor Morrison Home Corp (NYSE:TMHC)?

At Q4’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -29% from one quarter earlier. On the other hand, there were a total of 19 hedge funds with a bullish position in TMHC a year ago. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in Taylor Morrison Home Corp (NYSE:TMHC) was held by Long Pond Capital, which reported holding $59.1 million worth of stock at the end of September. It was followed by Greenhaven Associates with a $44.5 million position. Other investors bullish on the company included Echo Street Capital Management, Polar Capital, and D E Shaw.

Since Taylor Morrison Home Corp (NYSE:TMHC) has witnessed declining sentiment from hedge fund managers, it’s safe to say that there were a few funds that slashed their positions entirely heading into Q3. At the top of the heap, George Soros’s Soros Fund Management cut the biggest position of the “upper crust” of funds monitored by Insider Monkey, valued at close to $7.3 million in stock. Jim Simons’s fund, Renaissance Technologies, also said goodbye to its stock, about $6.3 million worth. These moves are interesting, as total hedge fund interest was cut by 6 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Taylor Morrison Home Corp (NYSE:TMHC). We will take a look at Medpace Holdings, Inc. (NASDAQ:MEDP), Commercial Metals Company (NYSE:CMC), Brooks Automation, Inc. (NASDAQ:BRKS), and Wingstop Inc (NASDAQ:WING). This group of stocks’ market caps match TMHC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MEDP | 23 | 170623 | -3 |

| CMC | 17 | 196848 | -1 |

| BRKS | 9 | 70789 | -3 |

| WING | 21 | 129095 | 4 |

| Average | 17.5 | 141839 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $142 million. That figure was $219 million in TMHC’s case. Medpace Holdings, Inc. (NASDAQ:MEDP) is the most popular stock in this table. On the other hand Brooks Automation, Inc. (NASDAQ:BRKS) is the least popular one with only 9 bullish hedge fund positions. Taylor Morrison Home Corp (NYSE:TMHC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on TMHC, though not to the same extent, as the stock returned 19.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.