We can judge whether International Speedway Corporation (NASDAQ:ISCA) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

International Speedway Corporation (NASDAQ:ISCA) investors should pay attention to an increase in enthusiasm from smart money in recent months. Our calculations also showed that isca isn’t among the 30 most popular stocks among hedge funds.

At the moment there are numerous indicators stock traders put to use to appraise their holdings. A duo of the less utilized indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the top money managers can beat the S&P 500 by a healthy margin (see the details here).

We’re going to take a gander at the latest hedge fund action regarding International Speedway Corporation (NASDAQ:ISCA).

What does the smart money think about International Speedway Corporation (NASDAQ:ISCA)?

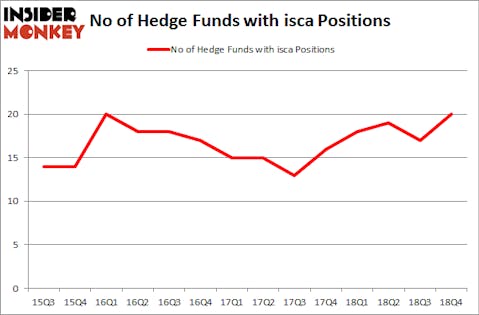

At Q4’s end, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ISCA over the last 14 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in International Speedway Corporation (NASDAQ:ISCA), which was worth $58.7 million at the end of the third quarter. On the second spot was Ariel Investments which amassed $14.6 million worth of shares. Moreover, Elliott Management, GLG Partners, and Millennium Management were also bullish on International Speedway Corporation (NASDAQ:ISCA), allocating a large percentage of their portfolios to this stock.

Consequently, key money managers have jumped into International Speedway Corporation (NASDAQ:ISCA) headfirst. Elliott Management, managed by Paul Singer, created the most outsized position in International Speedway Corporation (NASDAQ:ISCA). Elliott Management had $11.7 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $2.2 million position during the quarter. The following funds were also among the new ISCA investors: Dmitry Balyasny’s Balyasny Asset Management, Minhua Zhang’s Weld Capital Management, and Ken Griffin’s Citadel Investment Group.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as International Speedway Corporation (NASDAQ:ISCA) but similarly valued. We will take a look at Upwork Inc. (NASDAQ:UPWK), Arena Pharmaceuticals, Inc. (NASDAQ:ARNA), Cott Corporation (NYSE:COT), and Quidel Corporation (NASDAQ:QDEL). This group of stocks’ market caps are closest to ISCA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UPWK | 7 | 27815 | 7 |

| ARNA | 25 | 354292 | 0 |

| COT | 28 | 539524 | 3 |

| QDEL | 16 | 94379 | 1 |

| Average | 19 | 254003 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $254 million. That figure was $138 million in ISCA’s case. Cott Corporation (NYSE:COT) is the most popular stock in this table. On the other hand Upwork Inc. (NASDAQ:UPWK) is the least popular one with only 7 bullish hedge fund positions. International Speedway Corporation (NASDAQ:ISCA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ISCA wasn’t nearly as popular as these 15 stock and hedge funds that were betting on ISCA were disappointed as the stock returned -1.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.