Insider Monkey finished processing more than 700 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2018. In this article we are going to take a look at smart money sentiment towards Grupo Supervielle S.A. (NYSE:SUPV).

Hedge fund interest in Grupo Supervielle S.A. (NYSE:SUPV) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare SUPV to other stocks including Deciphera Pharmaceuticals, Inc. (NASDAQ:DCPH), AxoGen, Inc. (NASDAQ:AXGN), and Bandwidth Inc. (NASDAQ:BAND) to get a better sense of its popularity.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the key hedge fund action encompassing Grupo Supervielle S.A. (NYSE:SUPV).

How are hedge funds trading Grupo Supervielle S.A. (NYSE:SUPV)?

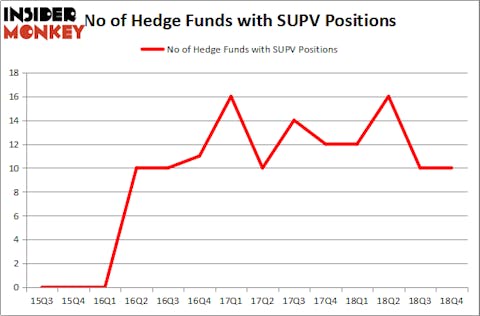

Heading into the first quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SUPV over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Kora Management, managed by Nitin Saigal and Dan Jacobs, holds the biggest position in Grupo Supervielle S.A. (NYSE:SUPV). Kora Management has a $20.8 million position in the stock, comprising 13.2% of its 13F portfolio. Coming in second is Discovery Capital Management, managed by Rob Citrone, which holds a $6.3 million position; the fund has 0.5% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions encompass James Dondero’s Highland Capital Management, Crispin Odey’s Odey Asset Management Group and Bruce J. Richards and Louis Hanover’s Marathon Asset Management.

Because Grupo Supervielle S.A. (NYSE:SUPV) has faced a decline in interest from the smart money, logic holds that there is a sect of funds that slashed their full holdings last quarter. At the top of the heap, Usman Waheed’s Strycker View Capital sold off the biggest investment of the “upper crust” of funds tracked by Insider Monkey, comprising close to $4 million in stock. Michael Barnes and Arif Inayatullah’s fund, Tricadia Capital Management, also sold off its stock, about $1.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Grupo Supervielle S.A. (NYSE:SUPV). We will take a look at Deciphera Pharmaceuticals, Inc. (NASDAQ:DCPH), AxoGen, Inc. (NASDAQ:AXGN), Bandwidth Inc. (NASDAQ:BAND), and U.S. Silica Holdings Inc (NYSE:SLCA). This group of stocks’ market caps are similar to SUPV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DCPH | 15 | 171040 | -1 |

| AXGN | 18 | 103389 | -3 |

| BAND | 19 | 103194 | 3 |

| SLCA | 14 | 177988 | -2 |

| Average | 16.5 | 138903 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $139 million. That figure was $44 million in SUPV’s case. Bandwidth Inc. (NASDAQ:BAND) is the most popular stock in this table. On the other hand U.S. Silica Holdings Inc (NYSE:SLCA) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Grupo Supervielle S.A. (NYSE:SUPV) is even less popular than SLCA. Hedge funds dodged a bullet by taking a bearish stance towards SUPV. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately SUPV wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); SUPV investors were disappointed as the stock returned -36.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.