Is Enanta Pharmaceuticals Inc (NASDAQ:ENTA) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

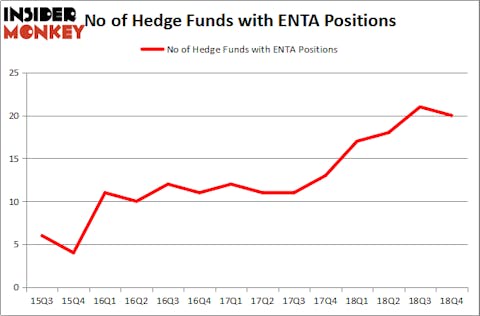

Enanta Pharmaceuticals Inc (NASDAQ:ENTA) has experienced a decrease in hedge fund interest lately. Our calculations also showed that ENTA isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are dozens of tools market participants can use to grade stocks. A duo of the most underrated tools are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top money managers can outpace the broader indices by a significant amount (see the details here).

We’re going to go over the key hedge fund action regarding Enanta Pharmaceuticals Inc (NASDAQ:ENTA).

What have hedge funds been doing with Enanta Pharmaceuticals Inc (NASDAQ:ENTA)?

At Q4’s end, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the second quarter of 2018. On the other hand, there were a total of 17 hedge funds with a bullish position in ENTA a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Farallon Capital held the most valuable stake in Enanta Pharmaceuticals Inc (NASDAQ:ENTA), which was worth $65.5 million at the end of the fourth quarter. On the second spot was Renaissance Technologies which amassed $56.5 million worth of shares. Moreover, Armistice Capital, AQR Capital Management, and Marshall Wace LLP were also bullish on Enanta Pharmaceuticals Inc (NASDAQ:ENTA), allocating a large percentage of their portfolios to this stock.

Because Enanta Pharmaceuticals Inc (NASDAQ:ENTA) has witnessed falling interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of money managers that elected to cut their entire stakes by the end of the third quarter. At the top of the heap, Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management dumped the largest stake of the “upper crust” of funds monitored by Insider Monkey, valued at about $7.9 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund dropped about $0.7 million worth. These moves are important to note, as total hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Enanta Pharmaceuticals Inc (NASDAQ:ENTA). These stocks are Atrion Corporation (NASDAQ:ATRI), Osisko Gold Royalties Ltd (NYSE:OR), Vector Group Ltd (NYSE:VGR), and Vanda Pharmaceuticals Inc. (NASDAQ:VNDA). This group of stocks’ market caps are closest to ENTA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATRI | 10 | 81331 | -1 |

| OR | 11 | 22535 | 1 |

| VGR | 20 | 158726 | 2 |

| VNDA | 19 | 376551 | -1 |

| Average | 15 | 159786 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $160 million. That figure was $205 million in ENTA’s case. Vector Group Ltd (NYSE:VGR) is the most popular stock in this table. On the other hand Atrion Corporation (NASDAQ:ATRI) is the least popular one with only 10 bullish hedge fund positions. Enanta Pharmaceuticals Inc (NASDAQ:ENTA) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on ENTA, though not to the same extent, as the stock returned 18% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.