How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Solid Biosciences Inc. (NASDAQ:SLDB).

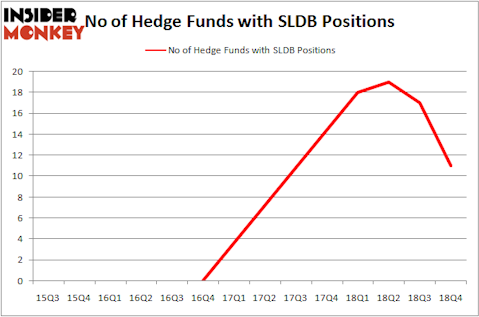

Solid Biosciences Inc. (NASDAQ:SLDB) investors should pay attention to a decrease in hedge fund interest recently. Our calculations also showed that SLDB isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are dozens of gauges shareholders can use to grade stocks. Two of the less known gauges are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the top investment managers can trounce the broader indices by a solid margin (see the details here).

We’re going to review the new hedge fund action regarding Solid Biosciences Inc. (NASDAQ:SLDB).

Hedge fund activity in Solid Biosciences Inc. (NASDAQ:SLDB)

Heading into the first quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -35% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SLDB over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Solid Biosciences Inc. (NASDAQ:SLDB) was held by Perceptive Advisors, which reported holding $105.2 million worth of stock at the end of December. It was followed by RA Capital Management with a $72.1 million position. Other investors bullish on the company included Partner Fund Management, EcoR1 Capital, and Cormorant Asset Management.

Because Solid Biosciences Inc. (NASDAQ:SLDB) has experienced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there exists a select few fund managers that elected to cut their full holdings heading into Q3. Intriguingly, Farallon Capital dumped the biggest position of the 700 funds watched by Insider Monkey, totaling close to $13.9 million in stock. Phill Gross and Robert Atchinson’s fund, Adage Capital Management, also said goodbye to its stock, about $6.6 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 6 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Solid Biosciences Inc. (NASDAQ:SLDB) but similarly valued. These stocks are National Bank Holdings Corp (NYSE:NBHC), The Buckle, Inc. (NYSE:BKE), Clovis Oncology Inc (NASDAQ:CLVS), and MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI). This group of stocks’ market caps are similar to SLDB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NBHC | 10 | 86835 | 1 |

| BKE | 13 | 31406 | -2 |

| CLVS | 24 | 452155 | -8 |

| MTSI | 15 | 108054 | 5 |

| Average | 15.5 | 169613 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $170 million. That figure was $285 million in SLDB’s case. Clovis Oncology Inc (NASDAQ:CLVS) is the most popular stock in this table. On the other hand National Bank Holdings Corp (NYSE:NBHC) is the least popular one with only 10 bullish hedge fund positions. Solid Biosciences Inc. (NASDAQ:SLDB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately SLDB wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); SLDB investors were disappointed as the stock returned -66.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.