The market has been volatile in the fourth quarter as the Federal Reserve continued its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Playa Hotels & Resorts N.V. (NASDAQ:PLYA) and find out how it is affected by hedge funds’ moves.

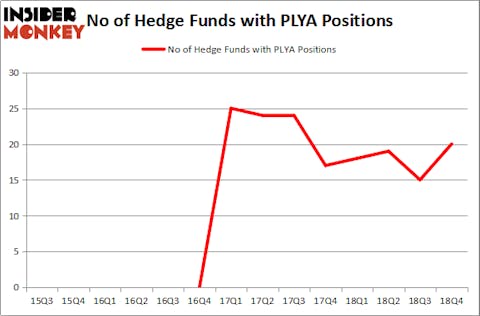

Playa Hotels & Resorts N.V. (NASDAQ:PLYA) was in 20 hedge funds’ portfolios at the end of December. PLYA has experienced an increase in enthusiasm from smart money in recent months. There were 15 hedge funds in our database with PLYA holdings at the end of the previous quarter. Our calculations also showed that PLYA isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of methods market participants use to evaluate their holdings. Some of the less known methods are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the best fund managers can trounce their index-focused peers by a significant margin (see the details here).

Let’s take a look at the fresh hedge fund action surrounding Playa Hotels & Resorts N.V. (NASDAQ:PLYA).

What have hedge funds been doing with Playa Hotels & Resorts N.V. (NASDAQ:PLYA)?

Heading into the first quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PLYA over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

The largest stake in Playa Hotels & Resorts N.V. (NASDAQ:PLYA) was held by Farallon Capital, which reported holding $220.1 million worth of stock at the end of December. It was followed by Armistice Capital with a $40.8 million position. Other investors bullish on the company included Empyrean Capital Partners, Governors Lane, and Marlowe Partners.

As one would reasonably expect, some big names have been driving this bullishness. HG Vora Capital Management, managed by Parag Vora, initiated the biggest position in Playa Hotels & Resorts N.V. (NASDAQ:PLYA). HG Vora Capital Management had $13.3 million invested in the company at the end of the quarter. Jonathan Kolatch’s Redwood Capital Management also made a $11.8 million investment in the stock during the quarter. The other funds with brand new PLYA positions are Dmitry Balyasny’s Balyasny Asset Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Marc Majzner’s Clearline Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Playa Hotels & Resorts N.V. (NASDAQ:PLYA). We will take a look at Continental Building Products Inc (NYSE:CBPX), Spectrum Pharmaceuticals, Inc. (NASDAQ:SPPI), Atkore International Group Inc. (NYSE:ATKR), and Retrophin Inc (NASDAQ:RTRX). This group of stocks’ market valuations are closest to PLYA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBPX | 16 | 82997 | -2 |

| SPPI | 17 | 83291 | -6 |

| ATKR | 17 | 90206 | -7 |

| RTRX | 22 | 373738 | 0 |

| Average | 18 | 157558 | -3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $158 million. That figure was $391 million in PLYA’s case. Retrophin Inc (NASDAQ:RTRX) is the most popular stock in this table. On the other hand Continental Building Products Inc (NYSE:CBPX) is the least popular one with only 16 bullish hedge fund positions. Playa Hotels & Resorts N.V. (NASDAQ:PLYA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately PLYA wasn’t nearly as popular as these 15 stock and hedge funds that were betting on PLYA were disappointed as the stock returned 12.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.