At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

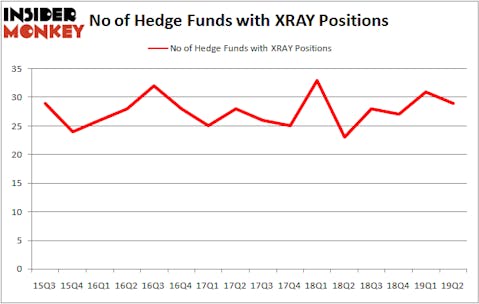

DENTSPLY SIRONA Inc. (NASDAQ:XRAY) has experienced a decrease in hedge fund sentiment lately. XRAY was in 29 hedge funds’ portfolios at the end of June. There were 31 hedge funds in our database with XRAY positions at the end of the previous quarter. Our calculations also showed that XRAY isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most stock holders, hedge funds are assumed to be slow, outdated financial tools of years past. While there are over 8000 funds with their doors open today, Our experts hone in on the aristocrats of this group, approximately 750 funds. These investment experts manage bulk of all hedge funds’ total capital, and by keeping an eye on their first-class picks, Insider Monkey has found a few investment strategies that have historically surpassed the market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to review the new hedge fund action encompassing DENTSPLY SIRONA Inc. (NASDAQ:XRAY).

How have hedgies been trading DENTSPLY SIRONA Inc. (NASDAQ:XRAY)?

At the end of the second quarter, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the previous quarter. By comparison, 23 hedge funds held shares or bullish call options in XRAY a year ago. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, David Blood and Al Gore’s Generation Investment Management has the number one position in DENTSPLY SIRONA Inc. (NASDAQ:XRAY), worth close to $985.6 million, accounting for 6.8% of its total 13F portfolio. The second largest stake is held by Select Equity Group, led by Robert Joseph Caruso, holding a $574 million position; the fund has 3.9% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions encompass Israel Englander’s Millennium Management, Ken Griffin’s Citadel Investment Group and D. E. Shaw’s D E Shaw.

Due to the fact that DENTSPLY SIRONA Inc. (NASDAQ:XRAY) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of hedge funds that elected to cut their full holdings heading into Q3. At the top of the heap, Jeffrey Talpins’s Element Capital Management cut the biggest stake of the 750 funds tracked by Insider Monkey, totaling about $12.2 million in stock. Efrem Kamen’s fund, Pura Vida Investments, also dumped its stock, about $10.4 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest was cut by 2 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to DENTSPLY SIRONA Inc. (NASDAQ:XRAY). These stocks are Celanese Corporation (NYSE:CE), Erie Indemnity Company (NASDAQ:ERIE), Host Hotels and Resorts Inc (NYSE:HST), and The J.M. Smucker Company (NYSE:SJM). This group of stocks’ market caps resemble XRAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CE | 20 | 635432 | -1 |

| ERIE | 12 | 89460 | -5 |

| HST | 28 | 513326 | 1 |

| SJM | 26 | 486152 | 0 |

| Average | 21.5 | 431093 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $431 million. That figure was $2223 million in XRAY’s case. Host Hotels and Resorts Inc (NYSE:HST) is the most popular stock in this table. On the other hand Erie Indemnity Company (NASDAQ:ERIE) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks DENTSPLY SIRONA Inc. (NASDAQ:XRAY) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately XRAY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on XRAY were disappointed as the stock returned -8.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.