Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. NASDAQ and Russell 2000 indices were already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points in the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Corcept Therapeutics Incorporated (NASDAQ:CORT).

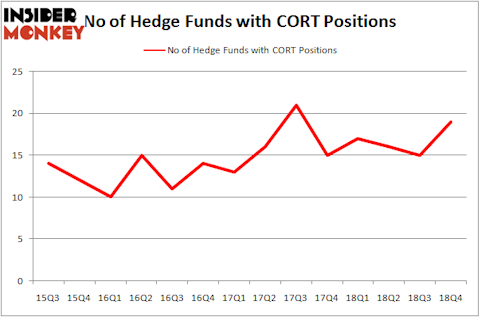

Corcept Therapeutics Incorporated (NASDAQ:CORT) was in 19 hedge funds’ portfolios at the end of the fourth quarter of 2018. CORT shareholders have witnessed an increase in support from the world’s most elite money managers recently. There were 15 hedge funds in our database with CORT holdings at the end of the previous quarter. Our calculations also showed that CORT isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most market participants, hedge funds are viewed as unimportant, outdated investment vehicles of yesteryear. While there are more than 8000 funds in operation today, We look at the leaders of this club, approximately 750 funds. These hedge fund managers watch over the lion’s share of all hedge funds’ total capital, and by tailing their unrivaled equity investments, Insider Monkey has identified various investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s view the latest hedge fund action regarding Corcept Therapeutics Incorporated (NASDAQ:CORT).

What does the smart money think about Corcept Therapeutics Incorporated (NASDAQ:CORT)?

At Q4’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from the second quarter of 2018. By comparison, 17 hedge funds held shares or bullish call options in CORT a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Consonance Capital Management, managed by Mitchell Blutt, holds the most valuable position in Corcept Therapeutics Incorporated (NASDAQ:CORT). Consonance Capital Management has a $83 million position in the stock, comprising 6.1% of its 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, managed by Jim Simons, which holds a $62.1 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining peers that hold long positions contain Israel Englander’s Millennium Management, Paul Marshall and Ian Wace’s Marshall Wace LLP and D. E. Shaw’s D E Shaw.

Now, key hedge funds have jumped into Corcept Therapeutics Incorporated (NASDAQ:CORT) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the most valuable position in Corcept Therapeutics Incorporated (NASDAQ:CORT). Arrowstreet Capital had $3 million invested in the company at the end of the quarter. Oleg Nodelman’s EcoR1 Capital also made a $2.2 million investment in the stock during the quarter. The other funds with new positions in the stock are John Overdeck and David Siegel’s Two Sigma Advisors and Minhua Zhang’s Weld Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Corcept Therapeutics Incorporated (NASDAQ:CORT) but similarly valued. We will take a look at CVR Refining LP (NYSE:CVRR), Acacia Communications, Inc. (NASDAQ:ACIA), SVMK Inc. (NASDAQ:SVMK), and Tupperware Brands Corporation (NYSE:TUP). This group of stocks’ market values are similar to CORT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVRR | 7 | 73753 | 5 |

| ACIA | 20 | 110480 | 3 |

| SVMK | 11 | 430626 | -13 |

| TUP | 22 | 158191 | 0 |

| Average | 15 | 193263 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $193 million. That figure was $190 million in CORT’s case. Tupperware Brands Corporation (NYSE:TUP) is the most popular stock in this table. On the other hand CVR Refining LP (NYSE:CVRR) is the least popular one with only 7 bullish hedge fund positions. Corcept Therapeutics Incorporated (NASDAQ:CORT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CORT wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CORT were disappointed as the stock returned -8.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.