Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

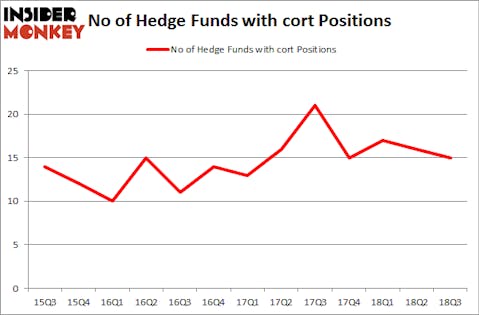

Is Corcept Therapeutics Incorporated (NASDAQ:CORT) going to take off soon? Hedge funds are taking a bearish view. The number of long hedge fund bets decreased by 1 in recent months. Our calculations also showed that cort isn’t among the 30 most popular stocks among hedge funds. CORT was in 15 hedge funds’ portfolios at the end of September. There were 16 hedge funds in our database with CORT holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Cliff Asness of AQR Capital Management

We’re going to review the latest hedge fund action encompassing Corcept Therapeutics Incorporated (NASDAQ:CORT).

How are hedge funds trading Corcept Therapeutics Incorporated (NASDAQ:CORT)?

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CORT over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Corcept Therapeutics Incorporated (NASDAQ:CORT) was held by Consonance Capital Management, which reported holding $70.6 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $61.9 million position. Other investors bullish on the company included GLG Partners, AQR Capital Management, and D E Shaw.

Seeing as Corcept Therapeutics Incorporated (NASDAQ:CORT) has experienced declining sentiment from the aggregate hedge fund industry, it’s easy to see that there is a sect of hedge funds who were dropping their positions entirely heading into Q3. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the largest stake of all the hedgies tracked by Insider Monkey, comprising close to $13.4 million in stock, and Ori Hershkovitz’s Nexthera Capital was right behind this move, as the fund said goodbye to about $5.3 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 1 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Corcept Therapeutics Incorporated (NASDAQ:CORT). We will take a look at The Gabelli Equity Trust Inc. (NYSE:GAB), LexinFintech Holdings Ltd. (NASDAQ:LX), PRA Group, Inc. (NASDAQ:PRAA), and Scholastic Corp (NASDAQ:SCHL). This group of stocks’ market caps resemble CORT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GAB | 1 | 5589 | -1 |

| LX | 8 | 11015 | 4 |

| PRAA | 7 | 167108 | -3 |

| SCHL | 11 | 110006 | 2 |

| Average | 6.75 | 73430 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $153 million in CORT’s case. Scholastic Corp (NASDAQ:SCHL) is the most popular stock in this table. On the other hand The Gabelli Equity Trust Inc. (NYSE:GAB) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Corcept Therapeutics Incorporated (NASDAQ:CORT) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.