The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Carnival Corporation & Plc (NYSE:CCL).

Carnival Corporation & Plc (NYSE:CCL) investors should pay attention to a decrease in activity from the world’s largest hedge funds in recent months. Our calculations also showed that CCL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are perceived as unimportant, old investment vehicles of yesteryear. While there are more than 8000 funds trading at the moment, Our researchers hone in on the masters of this club, approximately 750 funds. It is estimated that this group of investors command most of the smart money’s total asset base, and by tracking their matchless picks, Insider Monkey has brought to light a few investment strategies that have historically exceeded the market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a peek at the key hedge fund action surrounding Carnival Corporation & Plc (NYSE:CCL).

How have hedgies been trading Carnival Corporation & Plc (NYSE:CCL)?

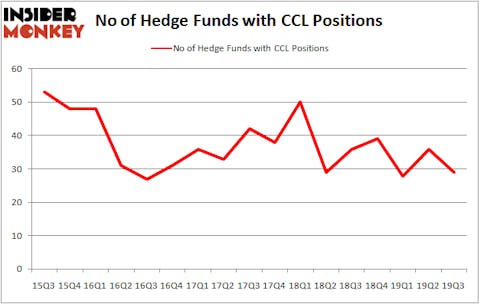

Heading into the fourth quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -19% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CCL over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the largest position in Carnival Corporation & Plc (NYSE:CCL). Arrowstreet Capital has a $192.4 million position in the stock, comprising 0.4% of its 13F portfolio. The second most bullish fund manager is John Overdeck and David Siegel of Two Sigma Advisors, with a $122.6 million position; 0.3% of its 13F portfolio is allocated to the company. Remaining peers that are bullish include Renaissance Technologies, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Cliff Asness’s AQR Capital Management. In terms of the portfolio weights assigned to each position MD Sass allocated the biggest weight to Carnival Corporation & Plc (NYSE:CCL), around 1.97% of its portfolio. Omega Advisors is also relatively very bullish on the stock, setting aside 1.6 percent of its 13F equity portfolio to CCL.

Due to the fact that Carnival Corporation & Plc (NYSE:CCL) has faced falling interest from the entirety of the hedge funds we track, we can see that there exists a select few fund managers who sold off their full holdings by the end of the third quarter. Intriguingly, Parag Vora’s HG Vora Capital Management sold off the biggest stake of all the hedgies monitored by Insider Monkey, comprising an estimated $58.2 million in stock, and John Khoury’s Long Pond Capital was right behind this move, as the fund dropped about $25.8 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest dropped by 7 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Carnival Corporation & Plc (NYSE:CCL) but similarly valued. These stocks are Fortive Corporation (NYSE:FTV), Archer Daniels Midland Company (NYSE:ADM), PPL Corporation (NYSE:PPL), and United Airlines Holdings, Inc. (NASDAQ:UAL). This group of stocks’ market valuations are similar to CCL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FTV | 34 | 803239 | 6 |

| ADM | 21 | 511939 | -5 |

| PPL | 24 | 516405 | 4 |

| UAL | 46 | 7090686 | -1 |

| Average | 31.25 | 2230567 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $2231 million. That figure was $589 million in CCL’s case. United Airlines Holdings, Inc. (NASDAQ:UAL) is the most popular stock in this table. On the other hand Archer Daniels Midland Company (NYSE:ADM) is the least popular one with only 21 bullish hedge fund positions. Carnival Corporation & Plc (NYSE:CCL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately CCL wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); CCL investors were disappointed as the stock returned 4.3% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.