Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 15 S&P 500 stocks among hedge funds at the end of December 2018 yielded an average return of 19.7% year-to-date, vs. a gain of 13.1% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Planet Fitness Inc (NYSE:PLNT).

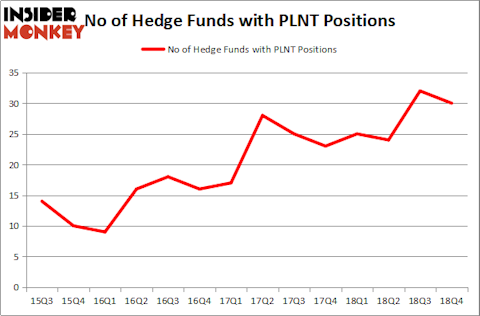

Planet Fitness Inc (NYSE:PLNT) was in 30 hedge funds’ portfolios at the end of the fourth quarter of 2018. PLNT shareholders have witnessed a decrease in hedge fund sentiment recently, though hedge fund sentiment is still very close to its all time high which was achieved at the end of September when there were 32 hedge funds in our database with PLNT positions. Our calculations also showed that PLNT isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are a large number of signals shareholders employ to evaluate publicly traded companies. Some of the most useful signals are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the best fund managers can outperform the S&P 500 by a solid amount (see the details here).

We’re going to take a glance at the fresh hedge fund action encompassing Planet Fitness Inc (NYSE:PLNT).

How have hedgies been trading Planet Fitness Inc (NYSE:PLNT)?

At Q4’s end, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the second quarter of 2018. On the other hand, there were a total of 25 hedge funds with a bullish position in PLNT a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Planet Fitness Inc (NYSE:PLNT), with a stake worth $71.4 million reported as of the end of September. Trailing Renaissance Technologies was Newbrook Capital Advisors, which amassed a stake valued at $47.6 million. Daruma Asset Management, Waratah Capital Advisors, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Planet Fitness Inc (NYSE:PLNT) has experienced falling interest from hedge fund managers, it’s easy to see that there was a specific group of hedgies that slashed their entire stakes heading into Q3. Intriguingly, James Crichton’s Hitchwood Capital Management dumped the biggest stake of all the hedgies watched by Insider Monkey, worth an estimated $32.4 million in stock, and Guy Shahar’s DSAM Partners was right behind this move, as the fund said goodbye to about $18.1 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 2 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Planet Fitness Inc (NYSE:PLNT). These stocks are ServiceMaster Global Holdings Inc (NYSE:SERV), Carvana Co. (NYSE:CVNA), Flowserve Corporation (NYSE:FLS), and Galapagos NV (NASDAQ:GLPG). This group of stocks’ market valuations match PLNT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SERV | 27 | 465302 | -9 |

| CVNA | 34 | 790686 | 1 |

| FLS | 16 | 178905 | 3 |

| GLPG | 15 | 92765 | -1 |

| Average | 23 | 381915 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $382 million. That figure was $376 million in PLNT’s case. Carvana Co. (NYSE:CVNA) is the most popular stock in this table. On the other hand Galapagos NV (NASDAQ:GLPG) is the least popular one with only 15 bullish hedge fund positions. Planet Fitness Inc (NYSE:PLNT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on PLNT as the stock returned 37.5% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.