Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

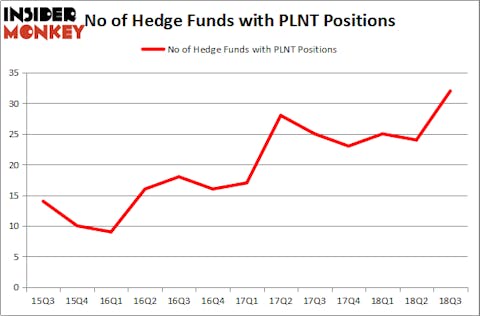

Planet Fitness Inc (NYSE:PLNT) shareholders have witnessed an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that PLNT isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s review the fresh hedge fund action surrounding Planet Fitness Inc (NYSE:PLNT).

What have hedge funds been doing with Planet Fitness Inc (NYSE:PLNT)?

Heading into the fourth quarter of 2018, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from the previous quarter. By comparison, 23 hedge funds held shares or bullish call options in PLNT heading into this year. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in Planet Fitness Inc (NYSE:PLNT) was held by Scopus Asset Management, which reported holding $60 million worth of stock at the end of September. It was followed by Marshall Wace LLP with a $55.2 million position. Other investors bullish on the company included Renaissance Technologies, Daruma Asset Management, and Melvin Capital Management.

As aggregate interest increased, some big names were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the biggest position in Planet Fitness Inc (NYSE:PLNT). Marshall Wace LLP had $55.2 million invested in the company at the end of the quarter. Gabriel Plotkin’s Melvin Capital Management also made a $39.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Lee Ainslie’s Maverick Capital, David Costen Haley’s HBK Investments, and Principal Global Investors’s Columbus Circle Investors.

Let’s also examine hedge fund activity in other stocks similar to Planet Fitness Inc (NYSE:PLNT). We will take a look at Monolithic Power Systems, Inc. (NASDAQ:MPWR), Syneos Health, Inc. (NASDAQ:SYNH), Brighthouse Financial, Inc. (NASDAQ:BHF), and Brixmor Property Group Inc (NYSE:BRX). All of these stocks’ market caps match PLNT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MPWR | 18 | 126619 | -3 |

| SYNH | 27 | 413900 | 8 |

| BHF | 22 | 1055138 | -6 |

| BRX | 18 | 291321 | 1 |

| Average | 21.25 | 471745 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $472 million. That figure was $506 million in PLNT’s case. Syneos Health, Inc. (NASDAQ:SYNH) is the most popular stock in this table. On the other hand Monolithic Power Systems, Inc. (NASDAQ:MPWR) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Planet Fitness Inc (NYSE:PLNT) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.