Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Ceridian HCM Holding Inc. (NYSE:CDAY) was in 17 hedge funds’ portfolios at the end of the fourth quarter of 2018. CDAY investors should be aware of a decrease in activity from the world’s largest hedge funds in recent months. There were 18 hedge funds in our database with CDAY positions at the end of the previous quarter. Our calculations also showed that CDAY isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are many metrics market participants can use to grade publicly traded companies. A pair of the best metrics are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can trounce the broader indices by a healthy amount (see the details here).

Let’s take a gander at the new hedge fund action encompassing Ceridian HCM Holding Inc. (NYSE:CDAY).

Hedge fund activity in Ceridian HCM Holding Inc. (NYSE:CDAY)

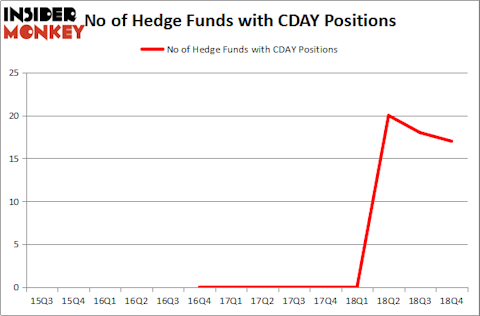

At Q4’s end, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CDAY over the last 14 quarters. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

More specifically, Select Equity Group was the largest shareholder of Ceridian HCM Holding Inc. (NYSE:CDAY), with a stake worth $191.1 million reported as of the end of September. Trailing Select Equity Group was Whale Rock Capital Management, which amassed a stake valued at $135.5 million. Ashe Capital, Junto Capital Management, and Brookside Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Since Ceridian HCM Holding Inc. (NYSE:CDAY) has faced falling interest from hedge fund managers, logic holds that there were a few hedgies that decided to sell off their full holdings in the third quarter. At the top of the heap, Jacob Doft’s Highline Capital Management sold off the largest investment of all the hedgies watched by Insider Monkey, comprising an estimated $47.6 million in stock. David Alexander Witkin’s fund, Beryl Capital Management, also cut its stock, about $3.8 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Ceridian HCM Holding Inc. (NYSE:CDAY) but similarly valued. These stocks are Cable One Inc (NYSE:CABO), Leggett & Platt, Inc. (NYSE:LEG), MDU Resources Group Inc (NYSE:MDU), and Sinopec Shanghai Petrochemical Company Limited (NYSE:SHI). This group of stocks’ market caps resemble CDAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CABO | 15 | 562023 | -3 |

| LEG | 9 | 34308 | -1 |

| MDU | 24 | 202819 | 5 |

| SHI | 6 | 13185 | 0 |

| Average | 13.5 | 203084 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $203 million. That figure was $542 million in CDAY’s case. MDU Resources Group Inc (NYSE:MDU) is the most popular stock in this table. On the other hand Sinopec Shanghai Petrochemical Company Limited (NYSE:SHI) is the least popular one with only 6 bullish hedge fund positions. Ceridian HCM Holding Inc. (NYSE:CDAY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on CDAY as the stock returned 47% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.