It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Index returned approximately 12.1% in the first 5 months of this year (through May 30th). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Comcast Corporation (NASDAQ:CMCSA).

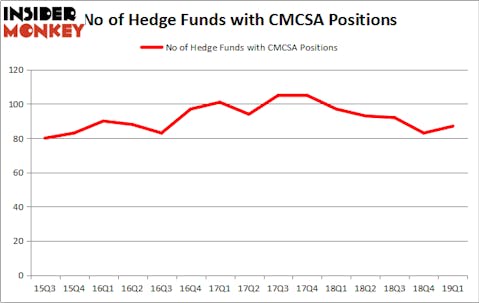

Comcast Corporation (NASDAQ:CMCSA) has seen an increase in hedge fund interest in recent months. CMCSA was in 87 hedge funds’ portfolios at the end of the first quarter of 2019. There were 83 hedge funds in our database with CMCSA positions at the end of the previous quarter. Our calculations also showed that CMCSA ranked 19th among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the fresh hedge fund action encompassing Comcast Corporation (NASDAQ:CMCSA).

Hedge fund activity in Comcast Corporation (NASDAQ:CMCSA)

At the end of the first quarter, a total of 87 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. On the other hand, there were a total of 97 hedge funds with a bullish position in CMCSA a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Eagle Capital Management held the most valuable stake in Comcast Corporation (NASDAQ:CMCSA), which was worth $1321.2 million at the end of the first quarter. On the second spot was First Pacific Advisors LLC which amassed $497.2 million worth of shares. Moreover, Two Sigma Advisors, Southeastern Asset Management, and AQR Capital Management were also bullish on Comcast Corporation (NASDAQ:CMCSA), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Suvretta Capital Management, managed by Aaron Cowen, established the largest position in Comcast Corporation (NASDAQ:CMCSA). Suvretta Capital Management had $150.4 million invested in the company at the end of the quarter. Karthik Sarma’s SRS Investment Management also made a $46.1 million investment in the stock during the quarter. The following funds were also among the new CMCSA investors: George Soros’s Soros Fund Management, Brandon Haley’s Holocene Advisors, and Joshua Nash’s Ulysses Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Comcast Corporation (NASDAQ:CMCSA) but similarly valued. These stocks are PepsiCo, Inc. (NASDAQ:PEP), Toyota Motor Corporation (NYSE:TM), Anheuser-Busch InBev SA/NV (NYSE:BUD), and HSBC Holdings plc (NYSE:HSBC). All of these stocks’ market caps match CMCSA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PEP | 51 | 4490981 | -2 |

| TM | 10 | 161453 | 2 |

| BUD | 22 | 1493242 | 1 |

| HSBC | 12 | 1080398 | 1 |

| Average | 23.75 | 1806519 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $1807 million. That figure was $6280 million in CMCSA’s case. PepsiCo, Inc. (NASDAQ:PEP) is the most popular stock in this table. On the other hand Toyota Motor Corporation (NYSE:TM) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Comcast Corporation (NASDAQ:CMCSA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CMCSA as the stock returned 4.9% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.