The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing more than 750 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th, 2019. In this article we are going to take a look at smart money sentiment towards Netflix, Inc. (NASDAQ:NFLX) and compare it against AstraZeneca plc (NYSE:AZN), Thermo Fisher Scientific Inc. (NYSE:TMO), Royal Bank of Canada (NYSE:RY), and Amgen, Inc. (NASDAQ:AMGN).

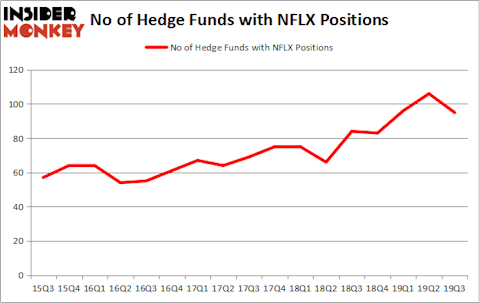

Is Netflix, Inc. (NASDAQ:NFLX) a buy right now? Money managers are taking a bearish view at the margin. The number of bullish hedge fund bets went down by 11 in recent months. Nevertheless our calculations also showed that NFLX ranked 14th among the 30 most popular stocks among hedge funds (see the video below). NFLX was in 95 hedge funds’ portfolios at the end of the third quarter of 2019. There were 106 hedge funds in our database with NFLX holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action regarding Netflix, Inc. (NASDAQ:NFLX).

How have hedgies been trading Netflix, Inc. (NASDAQ:NFLX)?

At the end of the third quarter, a total of 95 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from the previous quarter. By comparison, 84 hedge funds held shares or bullish call options in Netflix a year ago. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Viking Global, managed by Andreas Halvorsen, holds the biggest position in Netflix, Inc. (NASDAQ:NFLX). Viking Global has a $1.16 billion position in the stock, comprising 6% of its 13F portfolio. Coming in second is Karthik Sarma of SRS Investment Management, with a $1.1327 billion position; 30.6% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that are bullish contain Daniel Sundheim’s D1 Capital Partners, Stephen Mandel’s Lone Pine Capital and Ken Fisher’s Fisher Asset Management. In terms of the portfolio weights assigned to each position SRS Investment Management allocated the biggest weight to Netflix, Inc. (NASDAQ:NFLX), around 30.6% of its portfolio. Teewinot Capital Advisers is also relatively very bullish on the stock, dishing out 16.4 percent of its 13F equity portfolio to NFLX.

Judging by the fact that Netflix, Inc. (NASDAQ:NFLX) has witnessed declining sentiment from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of money managers who sold off their full holdings in the second quarter. Interestingly, Aaron Cowen’s Suvretta Capital Management cut the biggest investment of all the hedgies watched by Insider Monkey, valued at close to $261.2 million in stock. Alex Sacerdote’s fund, Whale Rock Capital Management, also said goodbye to its stock, about $185 million worth. These moves are interesting, as total hedge fund interest dropped by 11 funds in the second quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Netflix, Inc. (NASDAQ:NFLX) but similarly valued. These stocks are AstraZeneca plc (NYSE:AZN), Thermo Fisher Scientific Inc. (NYSE:TMO), Royal Bank of Canada (NYSE:RY), and Amgen, Inc. (NASDAQ:AMGN). This group of stocks’ market values match NFLX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AZN | 25 | 1779111 | 1 |

| TMO | 65 | 3444543 | -7 |

| RY | 17 | 491191 | 2 |

| AMGN | 48 | 2569750 | 6 |

| Average | 38.75 | 2071149 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.75 hedge funds with bullish positions and the average amount invested in these stocks was $2071 million. That figure was $8996 million in NFLX’s case. Thermo Fisher Scientific Inc. (NYSE:TMO) is the most popular stock in this table. On the other hand Royal Bank of Canada (NYSE:RY) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Netflix, Inc. (NASDAQ:NFLX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on NFLX as the stock returned 16% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.