“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk-adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Manulife Financial Corporation (NYSE:MFC) in order to identify whether reputable and successful top money managers continue to believe in its potential.

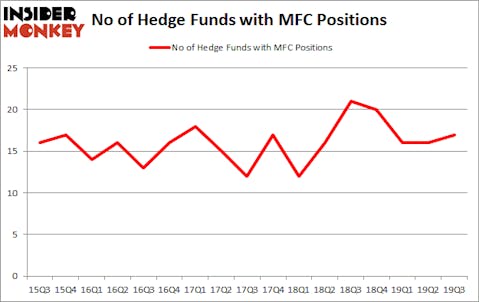

Manulife Financial Corporation (NYSE:MFC) was in 17 hedge funds’ portfolios at the end of September. MFC shareholders have witnessed an increase in hedge fund sentiment recently. There were 16 hedge funds in our database with MFC positions at the end of the previous quarter. Our calculations also showed that MFC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st-century investor’s toolkit there are several tools stock market investors have at their disposal to grade publicly traded companies. Two of the most underrated tools are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top money managers can outclass the market by a very impressive amount (see the details here).

Ken Griffin of Citadel Investment Group

We leave no stone unturned when looking for the next great investment idea. For example, Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a look at the fresh hedge fund action encompassing Manulife Financial Corporation (NYSE:MFC).

How are hedge funds trading Manulife Financial Corporation (NYSE:MFC)?

Heading into the fourth quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards MFC over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Manulife Financial Corporation (NYSE:MFC), which was worth $116.5 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $87.6 million worth of shares. Arrowstreet Capital, Two Sigma Advisors, and GLG Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position, Waratah Capital Advisors allocated the biggest weight to Manulife Financial Corporation (NYSE:MFC), around 1.62% of its 13F portfolio. Algert Coldiron Investors is also relatively very bullish on the stock, designating 0.18 percent of its 13F equity portfolio to MFC.

Consequently, key hedge funds have been driving this bullishness. Magnetar Capital, managed by Alec Litowitz and Ross Laser, established the largest position in Manulife Financial Corporation (NYSE:MFC). Magnetar Capital had $1 million invested in the company at the end of the quarter. Peter Algert and Kevin Coldiron’s Algert Coldiron Investors also initiated a $0.5 million position during the quarter. The only other fund with a brand new MFC position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Manulife Financial Corporation (NYSE:MFC) but similarly valued. These stocks are Baidu.com, Inc. (NASDAQ:BIDU), The Allstate Corporation (NYSE:ALL), V.F. Corporation (NYSE:VFC), and The Dow Chemical Company (NYSE:DOW). This group of stocks’ market caps are similar to MFC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BIDU | 43 | 1745303 | -1 |

| ALL | 44 | 1900363 | 7 |

| VFC | 33 | 920216 | 1 |

| DOW | 32 | 285661 | -1 |

| Average | 38 | 1212886 | 1.5 |

View the table here if you experience formatting issues.

As you can see these stocks had an average of 38 hedge funds with bullish positions and the average amount invested in these stocks was $1213 million. That figure was $355 million in MFC’s case. The Allstate Corporation (NYSE:ALL) is the most popular stock in this table. On the other hand, The Dow Chemical Company (NYSE:DOW) is the least popular one with only 32 bullish hedge fund positions. Compared to these stocks Manulife Financial Corporation (NYSE:MFC) is even less popular than DOW. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on MFC, though not to the same extent, as the stock returned 8.2% during the fourth quarter (through 11/30) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.