World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

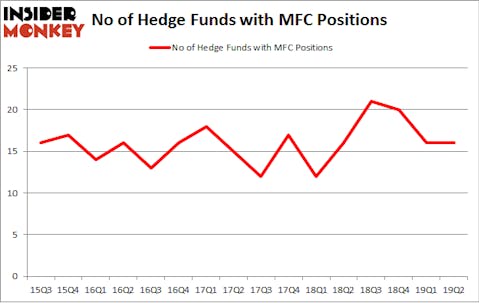

Manulife Financial Corporation (NYSE:MFC) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 16 hedge funds’ portfolios at the end of the second quarter of 2019. Our calculations also showed that MFC isn’t among the 30 most popular stocks among hedge funds (see the video at the end of this article). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Marathon Petroleum Corporation (NYSE:MPC), Ross Stores, Inc. (NASDAQ:ROST), and Anadarko Petroleum Corporation (NYSE:APC) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Noam Gottesman, GLG Partners

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the new hedge fund action regarding Manulife Financial Corporation (NYSE:MFC).

How are hedge funds trading Manulife Financial Corporation (NYSE:MFC)?

Heading into the third quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 16 hedge funds with a bullish position in MFC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Manulife Financial Corporation (NYSE:MFC), which was worth $71.4 million at the end of the second quarter. On the second spot was Citadel Investment Group which amassed $62.5 million worth of shares. Moreover, GLG Partners, Arrowstreet Capital, and Two Sigma Advisors were also bullish on Manulife Financial Corporation (NYSE:MFC), allocating a large percentage of their portfolios to this stock.

Seeing as Manulife Financial Corporation (NYSE:MFC) has experienced bearish sentiment from the smart money, we can see that there exists a select few funds that slashed their entire stakes last quarter. At the top of the heap, Cliff Asness’s AQR Capital Management dropped the biggest position of the “upper crust” of funds followed by Insider Monkey, valued at about $18.1 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund cut about $6.1 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Manulife Financial Corporation (NYSE:MFC) but similarly valued. We will take a look at Marathon Petroleum Corporation (NYSE:MPC), Ross Stores, Inc. (NASDAQ:ROST), Anadarko Petroleum Corporation (NYSE:APC), and Dollar General Corporation (NYSE:DG). All of these stocks’ market caps match MFC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MPC | 60 | 3075008 | -5 |

| ROST | 32 | 862087 | 3 |

| APC | 77 | 7591969 | 27 |

| DG | 37 | 1377605 | 6 |

| Average | 51.5 | 3226667 | 7.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 51.5 hedge funds with bullish positions and the average amount invested in these stocks was $3227 million. That figure was $277 million in MFC’s case. Anadarko Petroleum Corporation (NYSE:APC) is the most popular stock in this table. On the other hand Ross Stores, Inc. (NASDAQ:ROST) is the least popular one with only 32 bullish hedge fund positions. Compared to these stocks Manulife Financial Corporation (NYSE:MFC) is even less popular than ROST. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on MFC, though not to the same extent, as the stock returned 2.1% during the third quarter and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.