Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of March. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Manulife Financial Corporation (NYSE:MFC), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

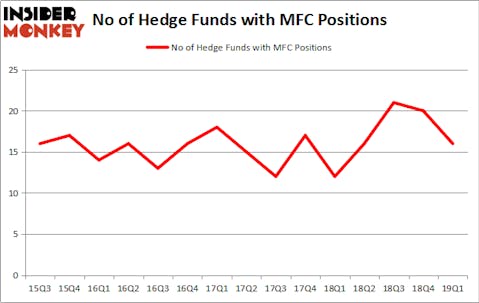

Is Manulife Financial Corporation (NYSE:MFC) ready to rally soon? The best stock pickers are reducing their bets on the stock. The number of long hedge fund positions were trimmed by 4 in recent months. Our calculations also showed that MFC isn’t among the 30 most popular stocks among hedge funds. MFC was in 16 hedge funds’ portfolios at the end of March. There were 20 hedge funds in our database with MFC positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the key hedge fund action surrounding Manulife Financial Corporation (NYSE:MFC).

How have hedgies been trading Manulife Financial Corporation (NYSE:MFC)?

Heading into the second quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MFC over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of Manulife Financial Corporation (NYSE:MFC), with a stake worth $141.3 million reported as of the end of March. Trailing Citadel Investment Group was Renaissance Technologies, which amassed a stake valued at $70.3 million. Two Sigma Advisors, Arrowstreet Capital, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since Manulife Financial Corporation (NYSE:MFC) has witnessed a decline in interest from the entirety of the hedge funds we track, logic holds that there is a sect of funds who were dropping their entire stakes last quarter. Interestingly, Peter Muller’s PDT Partners sold off the biggest investment of all the hedgies monitored by Insider Monkey, valued at about $1.9 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also cut its stock, about $0.9 million worth. These moves are interesting, as total hedge fund interest was cut by 4 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Manulife Financial Corporation (NYSE:MFC) but similarly valued. These stocks are Canadian Natural Resources Limited (NYSE:CNQ), Ferrari N.V. (NYSE:RACE), Red Hat, Inc. (NYSE:RHT), and Xilinx, Inc. (NASDAQ:XLNX). This group of stocks’ market valuations match MFC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNQ | 29 | 643752 | 5 |

| RACE | 28 | 1050992 | 0 |

| RHT | 66 | 5213219 | 1 |

| XLNX | 56 | 1633835 | 8 |

| Average | 44.75 | 2135450 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 44.75 hedge funds with bullish positions and the average amount invested in these stocks was $2135 million. That figure was $324 million in MFC’s case. Red Hat, Inc. (NYSE:RHT) is the most popular stock in this table. On the other hand Ferrari N.V. (NYSE:RACE) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks Manulife Financial Corporation (NYSE:MFC) is even less popular than RACE. Hedge funds clearly dropped the ball on MFC as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on MFC as the stock returned 6.6% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.