As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the third quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about The Chemours Company (NYSE:CC) and compare it against peers like Saia Inc (NASDAQ:SAIA), Lattice Semiconductor Corporation (NASDAQ:LSCC), Tilray, Inc. (NASDAQ:TLRY), and Prospect Capital Corporation (NASDAQ:PSEC).

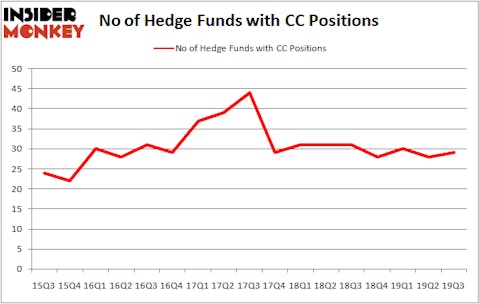

The Chemours Company (NYSE:CC) has experienced an increase in hedge fund interest lately. CC was in 29 hedge funds’ portfolios at the end of the third quarter of 2019. There were 28 hedge funds in our database with CC positions at the end of the previous quarter. Our calculations also showed that CC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are assumed to be unimportant, outdated investment tools of years past. While there are greater than 8000 funds in operation at the moment, Our researchers choose to focus on the upper echelon of this group, around 750 funds. These investment experts orchestrate the lion’s share of the hedge fund industry’s total capital, and by observing their unrivaled equity investments, Insider Monkey has figured out various investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to analyze the latest hedge fund action surrounding The Chemours Company (NYSE:CC).

Hedge fund activity in The Chemours Company (NYSE:CC)

At the end of the third quarter, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the previous quarter. On the other hand, there were a total of 31 hedge funds with a bullish position in CC a year ago. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Sessa Capital was the largest shareholder of The Chemours Company (NYSE:CC), with a stake worth $102.8 million reported as of the end of September. Trailing Sessa Capital was Greenlight Capital, which amassed a stake valued at $96.9 million. Arrowstreet Capital, Winton Capital Management, and Selz Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Sessa Capital allocated the biggest weight to The Chemours Company (NYSE:CC), around 11.72% of its portfolio. Greenlight Capital is also relatively very bullish on the stock, dishing out 6.97 percent of its 13F equity portfolio to CC.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Renaissance Technologies, created the largest position in The Chemours Company (NYSE:CC). Renaissance Technologies had $4.6 million invested in the company at the end of the quarter. Bill Miller’s Miller Value Partners also made a $3.6 million investment in the stock during the quarter. The other funds with brand new CC positions are Louis Bacon’s Moore Global Investments, Paul Marshall and Ian Wace’s Marshall Wace, and Peter Muller’s PDT Partners.

Let’s now review hedge fund activity in other stocks similar to The Chemours Company (NYSE:CC). We will take a look at Saia Inc (NASDAQ:SAIA), Lattice Semiconductor Corporation (NASDAQ:LSCC), Tilray, Inc. (NASDAQ:TLRY), and Prospect Capital Corporation (NASDAQ:PSEC). This group of stocks’ market values resemble CC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SAIA | 13 | 66696 | 4 |

| LSCC | 24 | 232643 | 4 |

| TLRY | 11 | 19410 | 0 |

| PSEC | 11 | 43044 | 0 |

| Average | 14.75 | 90448 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $90 million. That figure was $273 million in CC’s case. Lattice Semiconductor Corporation (NASDAQ:LSCC) is the most popular stock in this table. On the other hand Tilray, Inc. (NASDAQ:TLRY) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks The Chemours Company (NYSE:CC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on CC, though not to the same extent, as the stock returned 7.1% during the fourth quarter (through the end of November) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.