At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). We reversed our stance on March 25th after seeing unprecedented fiscal and monetary stimulus unleashed by the Fed and the Congress. This is the perfect market for stock pickers, now that the stocks are fully valued again. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Zogenix, Inc. (NASDAQ:ZGNX) at the end of the second quarter and determine whether the smart money was really smart about this stock.

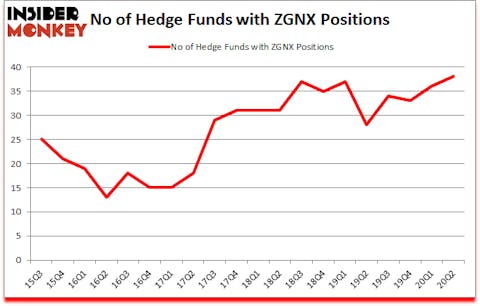

Zogenix, Inc. (NASDAQ:ZGNX) has seen an increase in hedge fund interest in recent months. Zogenix, Inc. (NASDAQ:ZGNX) was in 38 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 37. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that ZGNX isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are assumed to be worthless, outdated financial vehicles of the past. While there are over 8000 funds in operation today, We look at the bigwigs of this club, around 850 funds. It is estimated that this group of investors have their hands on bulk of all hedge funds’ total capital, and by monitoring their finest equity investments, Insider Monkey has revealed a few investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost precious metals prices. So, we are checking out this junior gold mining stock. Legal marijuana is one of the fastest growing industries right now, so we are checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind we’re going to view the key hedge fund action encompassing Zogenix, Inc. (NASDAQ:ZGNX).

How have hedgies been trading Zogenix, Inc. (NASDAQ:ZGNX)?

At second quarter’s end, a total of 38 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the previous quarter. By comparison, 28 hedge funds held shares or bullish call options in ZGNX a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Perceptive Advisors held the most valuable stake in Zogenix, Inc. (NASDAQ:ZGNX), which was worth $132.5 million at the end of the third quarter. On the second spot was RA Capital Management which amassed $99.3 million worth of shares. Avoro Capital Advisors (venBio Select Advisor), Farallon Capital, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Eversept Partners allocated the biggest weight to Zogenix, Inc. (NASDAQ:ZGNX), around 4.39% of its 13F portfolio. Logos Capital is also relatively very bullish on the stock, setting aside 2.16 percent of its 13F equity portfolio to ZGNX.

Now, specific money managers were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the biggest position in Zogenix, Inc. (NASDAQ:ZGNX). Arrowstreet Capital had $7.6 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $4.5 million investment in the stock during the quarter. The other funds with new positions in the stock are James Thomas Berylson’s Berylson Capital Partners, Bhagwan Jay Rao’s Integral Health Asset Management, and Michael Gelband’s ExodusPoint Capital.

Let’s go over hedge fund activity in other stocks similar to Zogenix, Inc. (NASDAQ:ZGNX). These stocks are Luminex Corporation (NASDAQ:LMNX), Rush Enterprises, Inc. (NASDAQ:RUSHA), Cerence Inc. (NASDAQ:CRNC), Kiniksa Pharmaceuticals, Ltd. (NASDAQ:KNSA), Urban Outfitters, Inc. (NASDAQ:URBN), Comfort Systems USA, Inc. (NYSE:FIX), and Mueller Water Products, Inc. (NYSE:MWA). All of these stocks’ market caps are similar to ZGNX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LMNX | 27 | 375386 | 12 |

| RUSHA | 18 | 59748 | 1 |

| CRNC | 14 | 148123 | 3 |

| KNSA | 18 | 294081 | 8 |

| URBN | 20 | 54759 | -3 |

| FIX | 22 | 80323 | 2 |

| MWA | 21 | 197650 | 1 |

| Average | 20 | 172867 | 3.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $173 million. That figure was $596 million in ZGNX’s case. Luminex Corporation (NASDAQ:LMNX) is the most popular stock in this table. On the other hand Cerence Inc. (NASDAQ:CRNC) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Zogenix, Inc. (NASDAQ:ZGNX) is more popular among hedge funds. Our overall hedge fund sentiment score for ZGNX is 87. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 33% in 2020 through the end of August and still beat the market by 23.2 percentage points. Unfortunately ZGNX wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on ZGNX were disappointed as the stock returned -12.4% since the end of the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Zogenix Inc. (NASDAQ:ZGNX)

Follow Zogenix Inc. (NASDAQ:ZGNX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.