Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged during the first quarter. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 40% and 25% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the first 5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

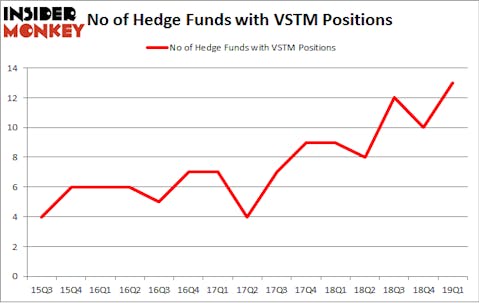

Verastem Inc (NASDAQ:VSTM) has seen an increase in activity from the world’s largest hedge funds recently. VSTM was in 13 hedge funds’ portfolios at the end of the first quarter of 2019. There were 10 hedge funds in our database with VSTM holdings at the end of the previous quarter. Our calculations also showed that vstm isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Noam Gottesman, GLG Partners

Let’s take a gander at the recent hedge fund action regarding Verastem Inc (NASDAQ:VSTM).

Hedge fund activity in Verastem Inc (NASDAQ:VSTM)

Heading into the second quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 30% from the previous quarter. The graph below displays the number of hedge funds with bullish position in VSTM over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Biotechnology Value Fund / BVF Inc was the largest shareholder of Verastem Inc (NASDAQ:VSTM), with a stake worth $10.4 million reported as of the end of March. Trailing Biotechnology Value Fund / BVF Inc was Renaissance Technologies, which amassed a stake valued at $3.2 million. Citadel Investment Group, GLG Partners, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, some big names have jumped into Verastem Inc (NASDAQ:VSTM) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, established the most outsized position in Verastem Inc (NASDAQ:VSTM). Marshall Wace LLP had $0.3 million invested in the company at the end of the quarter. Daniel S. Och’s OZ Management also made a $0.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Michael Platt and William Reeves’s BlueCrest Capital Mgmt. and David Harding’s Winton Capital Management.

Let’s go over hedge fund activity in other stocks similar to Verastem Inc (NASDAQ:VSTM). We will take a look at The New Germany Fund, Inc. (NYSE:GF), MEI Pharma Inc (NASDAQ:MEIP), Twin Disc, Incorporated (NASDAQ:TWIN), and Tiptree Inc. (NASDAQ:TIPT). All of these stocks’ market caps match VSTM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GF | 1 | 312 | 0 |

| MEIP | 15 | 60385 | -1 |

| TWIN | 5 | 31421 | -2 |

| TIPT | 5 | 3277 | 2 |

| Average | 6.5 | 23849 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $24 million. That figure was $21 million in VSTM’s case. MEI Pharma Inc (NASDAQ:MEIP) is the most popular stock in this table. On the other hand The New Germany Fund, Inc. (NYSE:GF) is the least popular one with only 1 bullish hedge fund positions. Verastem Inc (NASDAQ:VSTM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately VSTM wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on VSTM were disappointed as the stock returned -35.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.