A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by 4 percentage points during the first half of the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of Verastem Inc (NASDAQ:VSTM) during the quarter.

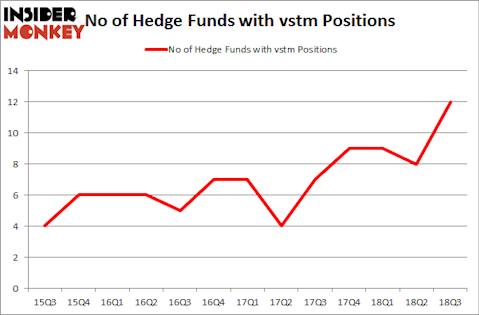

Verastem Inc (NASDAQ:VSTM) was in 12 hedge funds’ portfolios at the end of September. VSTM investors should pay attention to an increase in support from the world’s most elite money managers of late. There were 8 hedge funds in our database with VSTM positions at the end of the previous quarter. Our calculations also showed that vstm isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of methods stock traders can use to size up their holdings. Two of the most innovative methods are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the best hedge fund managers can outpace the S&P 500 by a solid margin (see the details here).

Cliff Asness of AQR Capital Management

Let’s go over the fresh hedge fund action surrounding Verastem Inc (NASDAQ:VSTM).

What have hedge funds been doing with Verastem Inc (NASDAQ:VSTM)?

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from the second quarter of 2018. By comparison, 9 hedge funds held shares or bullish call options in VSTM heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Verastem Inc (NASDAQ:VSTM) was held by Consonance Capital Management, which reported holding $37.4 million worth of stock at the end of September. It was followed by Biotechnology Value Fund / BVF Inc with a $14.4 million position. Other investors bullish on the company included GLG Partners, Citadel Investment Group, and AQR Capital Management.

As one would reasonably expect, key hedge funds have been driving this bullishness. GLG Partners, managed by Noam Gottesman, created the most outsized position in Verastem Inc (NASDAQ:VSTM). GLG Partners had $5.4 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $0.3 million position during the quarter. The other funds with new positions in the stock are Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, D. E. Shaw’s D E Shaw, and Mike Vranos’s Ellington.

Let’s go over hedge fund activity in other stocks similar to Verastem Inc (NASDAQ:VSTM). These stocks are Arrow Financial Corporation (NASDAQ:AROW), Cardlytics, Inc. (NASDAQ:CDLX), Carrols Restaurant Group, Inc. (NASDAQ:TAST), and Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL). All of these stocks’ market caps resemble VSTM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AROW | 4 | 12453 | 1 |

| CDLX | 7 | 31035 | -1 |

| TAST | 20 | 134724 | -1 |

| RIGL | 17 | 99159 | 0 |

| Average | 12 | 69343 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $69 million. That figure was $62 million in VSTM’s case. Carrols Restaurant Group, Inc. (NASDAQ:TAST) is the most popular stock in this table. On the other hand Arrow Financial Corporation (NASDAQ:AROW) is the least popular one with only 4 bullish hedge fund positions. Verastem Inc (NASDAQ:VSTM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TAST might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.