Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Mimecast Limited (NASDAQ:MIME).

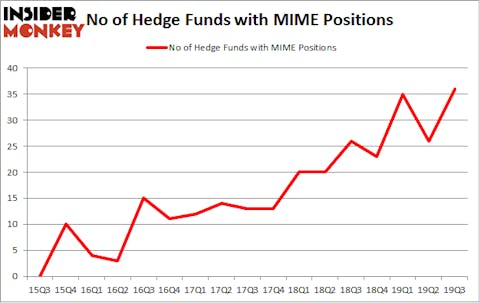

Mimecast Limited (NASDAQ:MIME) has experienced an increase in hedge fund interest recently. Our calculations also showed that MIME isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most stock holders, hedge funds are assumed to be worthless, old financial vehicles of yesteryear. While there are more than 8000 funds in operation at present, Our experts look at the leaders of this group, around 750 funds. These money managers shepherd most of all hedge funds’ total asset base, and by keeping track of their matchless equity investments, Insider Monkey has figured out numerous investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Colin Moran of Abdiel Capital Advisors

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s view the fresh hedge fund action encompassing Mimecast Limited (NASDAQ:MIME).

What does smart money think about Mimecast Limited (NASDAQ:MIME)?

At the end of the third quarter, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MIME over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Mimecast Limited (NASDAQ:MIME) was held by Whale Rock Capital Management, which reported holding $135.3 million worth of stock at the end of September. It was followed by Abdiel Capital Advisors with a $131.4 million position. Other investors bullish on the company included SQN Investors, Renaissance Technologies, and Polar Capital. In terms of the portfolio weights assigned to each position Berylson Capital Partners allocated the biggest weight to Mimecast Limited (NASDAQ:MIME), around 10.77% of its portfolio. Abdiel Capital Advisors is also relatively very bullish on the stock, setting aside 8.07 percent of its 13F equity portfolio to MIME.

Consequently, key money managers have jumped into Mimecast Limited (NASDAQ:MIME) headfirst. Carlson Capital, managed by Clint Carlson, assembled the most valuable position in Mimecast Limited (NASDAQ:MIME). Carlson Capital had $25.9 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $21.1 million position during the quarter. The following funds were also among the new MIME investors: Sander Gerber’s Hudson Bay Capital Management, Bernard Selz’s Selz Capital, and James Thomas Berylson’s Berylson Capital Partners.

Let’s also examine hedge fund activity in other stocks similar to Mimecast Limited (NASDAQ:MIME). These stocks are Washington Real Estate Investment Trust (NYSE:WRE), Stepan Company (NYSE:SCL), Invesco Mortgage Capital Inc (NYSE:IVR), and Innospec Inc. (NASDAQ:IOSP). This group of stocks’ market values match MIME’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WRE | 5 | 115764 | -1 |

| SCL | 14 | 61752 | 3 |

| IVR | 17 | 85348 | 6 |

| IOSP | 19 | 98572 | 6 |

| Average | 13.75 | 90359 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $90 million. That figure was $669 million in MIME’s case. Innospec Inc. (NASDAQ:IOSP) is the most popular stock in this table. On the other hand Washington Real Estate Investment Trust (NYSE:WRE) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Mimecast Limited (NASDAQ:MIME) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on MIME as the stock returned 24.3% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.