Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 24.4% during the first 9 months of 2019 and outperformed the broader market benchmark by 4 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

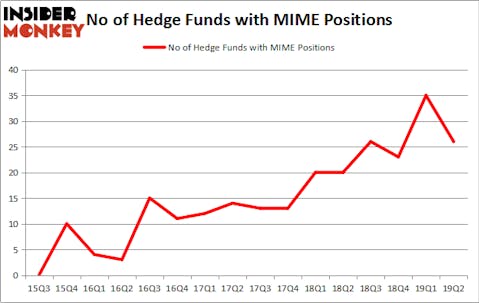

Mimecast Limited (NASDAQ:MIME) has seen a decrease in activity from the world’s largest hedge funds recently. MIME was in 26 hedge funds’ portfolios at the end of June. There were 35 hedge funds in our database with MIME holdings at the end of the previous quarter. Our calculations also showed that MIME isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are viewed as underperforming, old financial tools of years past. While there are greater than 8000 funds trading today, We choose to focus on the masters of this club, approximately 750 funds. Most estimates calculate that this group of people have their hands on bulk of the hedge fund industry’s total capital, and by watching their highest performing stock picks, Insider Monkey has revealed a few investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s review the key hedge fund action surrounding Mimecast Limited (NASDAQ:MIME).

Hedge fund activity in Mimecast Limited (NASDAQ:MIME)

Heading into the third quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -26% from the previous quarter. On the other hand, there were a total of 20 hedge funds with a bullish position in MIME a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Whale Rock Capital Management was the largest shareholder of Mimecast Limited (NASDAQ:MIME), with a stake worth $177.4 million reported as of the end of March. Trailing Whale Rock Capital Management was Abdiel Capital Advisors, which amassed a stake valued at $172.1 million. SQN Investors, Holocene Advisors, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Mimecast Limited (NASDAQ:MIME) has faced declining sentiment from the aggregate hedge fund industry, we can see that there lies a certain “tier” of fund managers that elected to cut their entire stakes in the second quarter. Interestingly, Charles Clough’s Clough Capital Partners cut the biggest position of all the hedgies tracked by Insider Monkey, valued at about $8.2 million in stock, and Bijan Modanlou, Joseph Bou-Saba, and Jayaveera Kodali’s Alta Park Capital was right behind this move, as the fund dumped about $6.2 million worth. These moves are interesting, as aggregate hedge fund interest fell by 9 funds in the second quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Mimecast Limited (NASDAQ:MIME) but similarly valued. These stocks are Steven Madden, Ltd. (NASDAQ:SHOO), Pivotal Software, Inc. (NYSE:PVTL), Magnolia Oil & Gas Corporation (NYSE:MGY), and Dorman Products Inc. (NASDAQ:DORM). All of these stocks’ market caps match MIME’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHOO | 14 | 48056 | -4 |

| PVTL | 20 | 169491 | -5 |

| MGY | 19 | 172385 | -13 |

| DORM | 14 | 65216 | -1 |

| Average | 16.75 | 113787 | -5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $114 million. That figure was $846 million in MIME’s case. Pivotal Software, Inc. (NYSE:PVTL) is the most popular stock in this table. On the other hand Steven Madden, Ltd. (NASDAQ:SHOO) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Mimecast Limited (NASDAQ:MIME) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MIME wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MIME were disappointed as the stock returned -23.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.