At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not International Paper Company (NYSE:IP) makes for a good investment right now.

Is International Paper Company (NYSE:IP) the right pick for your portfolio? Hedge funds are buying. The number of long hedge fund positions went up by 6 in recent months. Overall hedge fund sentiment towards IP is now at an all time high. This is usually a very bullish signal. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed a similar performance from Progressive Corporation (PGR) which returned 27% and outperformed the SPY by nearly 14 percentage points in 2.5 months. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management Inc. (BAM), Atlassian Corporation Plc (TEAM), RCL, MTB and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a gander at the key hedge fund action regarding International Paper Company (NYSE:IP).

How are hedge funds trading International Paper Company (NYSE:IP)?

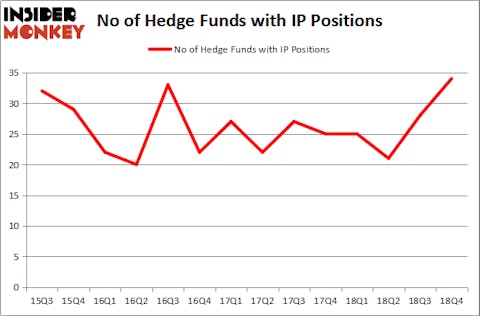

At the end of the fourth quarter, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 21% from the previous quarter. By comparison, 25 hedge funds held shares or bullish call options in IP a year ago. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

More specifically, AQR Capital Management was the largest shareholder of International Paper Company (NYSE:IP), with a stake worth $87.3 million reported as of the end of September. Trailing AQR Capital Management was Levin Capital Strategies, which amassed a stake valued at $83.7 million. Bridgewater Associates, Millennium Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names have jumped into International Paper Company (NYSE:IP) headfirst. Two Sigma Advisors, managed by John Overdeck and David Siegel, assembled the biggest position in International Paper Company (NYSE:IP). Two Sigma Advisors had $10.4 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $6.3 million position during the quarter. The following funds were also among the new IP investors: Dmitry Balyasny’s Balyasny Asset Management, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Jeffrey Talpins’s Element Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to International Paper Company (NYSE:IP). We will take a look at Smith & Nephew plc (NYSE:SNN), Check Point Software Technologies Ltd. (NASDAQ:CHKP), Global Payments Inc (NYSE:GPN), and Nucor Corporation (NYSE:NUE). All of these stocks’ market caps are closest to IP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNN | 11 | 368173 | 2 |

| CHKP | 26 | 727516 | 0 |

| GPN | 27 | 476456 | 1 |

| NUE | 26 | 393481 | -5 |

| Average | 22.5 | 491407 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $491 million. That figure was $435 million in IP’s case. Global Payments Inc (NYSE:GPN) is the most popular stock in this table. On the other hand Smith & Nephew plc (NYSE:SNN) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks International Paper Company (NYSE:IP) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on IP, though not to the same extent, as the stock returned 14% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.