It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Columbus McKinnon Corporation (NASDAQ:CMCO).

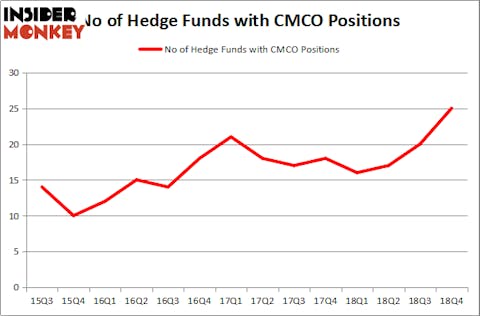

Is Columbus McKinnon Corporation (NASDAQ:CMCO) an exceptional investment today? Prominent investors are buying. The number of long hedge fund positions inched up by 5 recently. Our calculations also showed that CMCO isn’t among the 30 most popular stocks among hedge funds. CMCO was in 25 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 20 hedge funds in our database with CMCO positions at the end of the previous quarter.

To the average investor there are several gauges shareholders have at their disposal to value stocks. Some of the most underrated gauges are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the top investment managers can outperform the market by a very impressive amount (see the details here).

Let’s take a look at the key hedge fund action surrounding Columbus McKinnon Corporation (NASDAQ:CMCO).

How are hedge funds trading Columbus McKinnon Corporation (NASDAQ:CMCO)?

At the end of the fourth quarter, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CMCO over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Driehaus Capital held the most valuable stake in Columbus McKinnon Corporation (NASDAQ:CMCO), which was worth $9.6 million at the end of the fourth quarter. On the second spot was Marshall Wace LLP which amassed $6.8 million worth of shares. Moreover, Renaissance Technologies, Spitfire Capital, and Skylands Capital were also bullish on Columbus McKinnon Corporation (NASDAQ:CMCO), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key money managers have jumped into Columbus McKinnon Corporation (NASDAQ:CMCO) headfirst. Divisar Capital, managed by Steven Baughman, created the biggest position in Columbus McKinnon Corporation (NASDAQ:CMCO). Divisar Capital had $3 million invested in the company at the end of the quarter. Dan Friedberg’s Sagard Capital Partners Management Corp also made a $2.5 million investment in the stock during the quarter. The other funds with brand new CMCO positions are Matthew Hulsizer’s PEAK6 Capital Management and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Columbus McKinnon Corporation (NASDAQ:CMCO) but similarly valued. These stocks are Consolidated Communications Holdings Inc (NASDAQ:CNSL), Novavax, Inc. (NASDAQ:NVAX), Lakeland Bancorp, Inc. (NASDAQ:LBAI), and Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX). This group of stocks’ market caps are similar to CMCO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNSL | 14 | 10831 | 4 |

| NVAX | 13 | 29470 | 1 |

| LBAI | 12 | 59102 | 0 |

| LXRX | 11 | 10453 | 1 |

| Average | 12.5 | 27464 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $27 million. That figure was $66 million in CMCO’s case. Consolidated Communications Holdings Inc (NASDAQ:CNSL) is the most popular stock in this table. On the other hand Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Columbus McKinnon Corporation (NASDAQ:CMCO) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on CMCO as the stock returned 31.9% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.