Insider Monkey finished processing more than 730 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of June 28th, 2019. What do these smart investors think about Berkshire Hathaway Inc. (NYSE:BRK-B)?

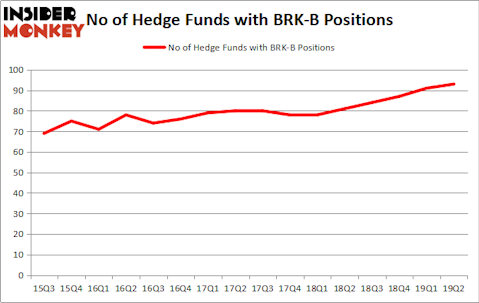

Is Berkshire Hathaway Inc. (NYSE:BRK-B) a great stock to buy now? Hedge funds are becoming more confident. The number of long hedge fund bets advanced by 2 lately. Overall hedge fund sentiment towards the stock reached an all-time high. Our calculations also showed that BRK-B currently ranks 14th among the 30 most popular stocks among hedge funds. BRK-B was in 93 hedge funds’ portfolios at the end of the second quarter of 2019. There were 91 hedge funds in our database with BRK-B positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the recent hedge fund action regarding Berkshire Hathaway Inc. (NYSE:BRK-B).

What have hedge funds been doing with Berkshire Hathaway Inc. (NYSE:BRK.B)?

Heading into the third quarter of 2019, a total of 93 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 2% from the previous quarter. By comparison, 81 hedge funds held shares or bullish call options in BRK-B a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Michael Larson’s Bill & Melinda Gates Foundation Trust has the most valuable position in Berkshire Hathaway Inc. (NYSE:BRK.B), worth close to $10.0358 billion, amounting to 50.6% of its total 13F portfolio. Coming in second is Eagle Capital Management, managed by Boykin Curry, which holds a $2.1228 billion position; the fund has 7.4% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish consist of Tom Russo’s Gardner Russo & Gardner, and Bill Ackman’s Pershing Square.

As one would reasonably expect, specific money managers have been driving this bullishness. Pershing Square, managed by Bill Ackman, assembled the biggest position in Berkshire Hathaway Inc. (NYSE:BRK.B). Pershing Square had $748.9 million invested in the company at the end of the quarter. Glenn Greenberg’s Brave Warrior Capital also initiated a $268.5 million position during the quarter. The other funds with new positions in the stock are Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors, Parvinder Thiara’s Athanor Capital, and David Costen Haley’s HBK Investments.

Let’s go over hedge fund activity in other stocks similar to Berkshire Hathaway Inc. (NYSE:BRK.B). We will take a look at Alibaba Group Holding Limited (NYSE:BABA), Visa Inc (NYSE:V), Johnson & Johnson (NYSE:JNJ), and JPMorgan Chase & Co. (NYSE:JPM). This group of stocks’ market values are similar to BRK-B’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BABA | 127 | 16582991 | 10 |

| V | 117 | 15186566 | -7 |

| JNJ | 63 | 6757234 | -6 |

| JPM | 90 | 11264732 | -10 |

| Average | 99.25 | 12447881 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 99.25 hedge funds with bullish positions and the average amount invested in these stocks was $12448 million. That figure was $21144 million in BRK-B’s case. Alibaba Group Holding Limited (NYSE:BABA) is the most popular stock in this table. On the other hand Johnson & Johnson (NYSE:JNJ) is the least popular one with only 63 bullish hedge fund positions. Berkshire Hathaway Inc. (NYSE:BRK.B) is not the least popular stock in this group but hedge fund interest is still below average compared to its peer group. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately BRK-B wasn’t nearly as successful as these 20 stocks; BRK-B investors were disappointed as the stock returned -2.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.