We are still in an overall bull market and many stocks that smart money investors were piling into surged through November 22nd. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 52% and 49% respectively. Hedge funds’ top 3 stock picks returned 39.1% this year and beat the S&P 500 ETFs by nearly 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Aon plc (NYSE:AON).

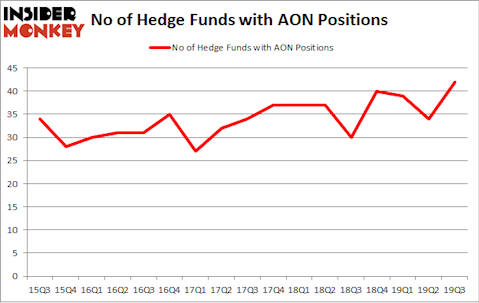

Is Aon plc (NYSE:AON) ready to rally soon? Hedge funds are becoming more confident. The number of bullish hedge fund bets increased by 8 in recent months. Our calculations also showed that AON isn’t among the 30 most popular stocks among hedge funds. AON was in 42 hedge funds’ portfolios at the end of September. There were 34 hedge funds in our database with AON holdings at the end of the previous quarter.

According to most stock holders, hedge funds are seen as worthless, outdated financial tools of years past. While there are greater than 8000 funds in operation today, Our researchers look at the elite of this group, about 750 funds. These money managers control the lion’s share of the hedge fund industry’s total asset base, and by paying attention to their highest performing stock picks, Insider Monkey has determined a few investment strategies that have historically surpassed the market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Boykin Curry of Eagle Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to view the recent hedge fund action encompassing Aon plc (NYSE:AON).

Hedge fund activity in Aon plc (NYSE:AON)

At the end of the third quarter, a total of 42 of the hedge funds tracked by Insider Monkey were long this stock, a change of 24% from the previous quarter. On the other hand, there were a total of 30 hedge funds with a bullish position in AON a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Among these funds, Eagle Capital Management held the most valuable stake in Aon plc (NYSE:AON), which was worth $853.4 million at the end of the third quarter. On the second spot was Cantillon Capital Management which amassed $276.6 million worth of shares. First Pacific Advisors, Iridian Asset Management, and Viking Global were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Permian Investment Partners allocated the biggest weight to Aon plc (NYSE:AON), around 8.84% of its portfolio. BloombergSen is also relatively very bullish on the stock, dishing out 8.52 percent of its 13F equity portfolio to AON.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Aon plc (NYSE:AON) headfirst. Carlson Capital, managed by Clint Carlson, established the most valuable position in Aon plc (NYSE:AON). Carlson Capital had $17 million invested in the company at the end of the quarter. Peter Seuss’s Prana Capital Management also initiated a $14.4 million position during the quarter. The other funds with new positions in the stock are Greg Poole’s Echo Street Capital Management, Jay Genzer’s Thames Capital Management, and David E. Shaw’s D E Shaw.

Let’s now review hedge fund activity in other stocks similar to Aon plc (NYSE:AON). These stocks are The Progressive Corporation (NYSE:PGR), Illumina, Inc. (NASDAQ:ILMN), Baxter International Inc. (NYSE:BAX), and Las Vegas Sands Corp. (NYSE:LVS). This group of stocks’ market valuations are closest to AON’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PGR | 48 | 1562764 | -2 |

| ILMN | 37 | 1183062 | -6 |

| BAX | 33 | 2445089 | -1 |

| LVS | 39 | 1983338 | 0 |

| Average | 39.25 | 1793563 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.25 hedge funds with bullish positions and the average amount invested in these stocks was $1794 million. That figure was $2479 million in AON’s case. The Progressive Corporation (NYSE:PGR) is the most popular stock in this table. On the other hand Baxter International Inc. (NYSE:BAX) is the least popular one with only 33 bullish hedge fund positions. Aon plc (NYSE:AON) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately AON wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on AON were disappointed as the stock returned 3.3% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.