At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of March 31. In this article, we will use that wealth of knowledge to determine whether or not Anthem Inc (NYSE:ANTM) makes for a good investment right now.

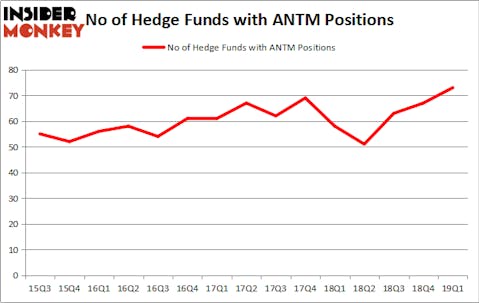

Anthem Inc (NYSE:ANTM) was in 73 hedge funds’ portfolios at the end of March. ANTM has experienced an increase in support from the world’s most elite money managers recently. There were 67 hedge funds in our database with ANTM holdings at the end of the previous quarter. Our calculations also showed that ANTM ranked 26th among the 30 most popular stocks among hedge funds. Overall hedge fund sentiment towards the stock is currently at its all time high. This is usually a bullish signal. We observed this in three other stocks: Disney Worldpay, and Adobe Systems. Disney outperformed the market by 20 percentage points whereas Worldpay and Adobe beat it by 8 and 4 points respectively.

At the moment there are dozens of tools shareholders can use to analyze their holdings. Some of the most underrated tools are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can outperform the S&P 500 by a very impressive margin (see the details here).

Let’s take a gander at the recent hedge fund action encompassing Anthem Inc (NYSE:ANTM).

Hedge fund activity in Anthem Inc (NYSE:ANTM)

At Q1’s end, a total of 73 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from the previous quarter. By comparison, 58 hedge funds held shares or bullish call options in ANTM a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Viking Global held the most valuable stake in Anthem Inc (NYSE:ANTM), which was worth $1777.8 million at the end of the first quarter. On the second spot was AQR Capital Management which amassed $740.5 million worth of shares. Moreover, Orbis Investment Management, Glenview Capital, and Farallon Capital were also bullish on Anthem Inc (NYSE:ANTM), allocating a large percentage of their portfolios to this stock.

Now, key hedge funds have jumped into Anthem Inc (NYSE:ANTM) headfirst. Miura Global Management, managed by Pasco Alfaro / Richard Tumure, assembled the most valuable position in Anthem Inc (NYSE:ANTM). Miura Global Management had $14.3 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $13.2 million position during the quarter. The other funds with new positions in the stock are Joe DiMenna’s ZWEIG DIMENNA PARTNERS, Jesse Ro’s Tiger Legatus Capital, and Brian Ashford-Russell and Tim Woolley’s Polar Capital.

Let’s go over hedge fund activity in other stocks similar to Anthem Inc (NYSE:ANTM). We will take a look at Stryker Corporation (NYSE:SYK), Enbridge Inc (NYSE:ENB), Banco Bradesco SA (NYSE:BBD), and Equinor ASA (NYSE:EQNR). All of these stocks’ market caps match ANTM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYK | 34 | 635206 | -10 |

| ENB | 20 | 173528 | 2 |

| BBD | 18 | 753361 | 2 |

| EQNR | 10 | 352240 | -3 |

| Average | 20.5 | 478584 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $479 million. That figure was $6148 million in ANTM’s case. Stryker Corporation (NYSE:SYK) is the most popular stock in this table. On the other hand Equinor ASA (NYSE:EQNR) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Anthem Inc (NYSE:ANTM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately ANTM wasn’t nearly as successful as these 20 stocks and hedge funds that were betting on ANTM were disappointed as the stock returned -3.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market this year.

In this case we believe hedge funds were a little bit early piling into the stock. ANTM shares actually declined nearly 20% in early April and currently is on its way recouping those losses. We wouldn’t be surprised if ANTM outperforms the market in June.

Disclosure: None. This article was originally published at Insider Monkey.