Is Altair Engineering Inc. (NASDAQ:ALTR) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

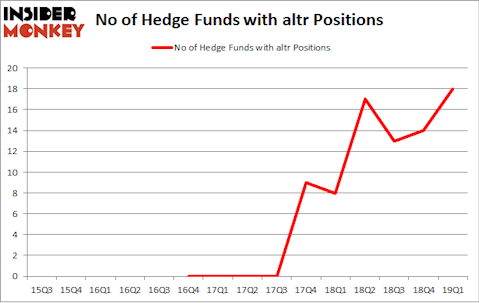

Altair Engineering Inc. (NASDAQ:ALTR) investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that altr isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the key hedge fund action encompassing Altair Engineering Inc. (NASDAQ:ALTR).

Hedge fund activity in Altair Engineering Inc. (NASDAQ:ALTR)

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 29% from one quarter earlier. On the other hand, there were a total of 8 hedge funds with a bullish position in ALTR a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Polar Capital was the largest shareholder of Altair Engineering Inc. (NASDAQ:ALTR), with a stake worth $22.3 million reported as of the end of March. Trailing Polar Capital was Driehaus Capital, which amassed a stake valued at $15.1 million. Two Sigma Advisors, Arrowstreet Capital, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key money managers were leading the bulls’ herd. AQR Capital Management, managed by Cliff Asness, established the most outsized position in Altair Engineering Inc. (NASDAQ:ALTR). AQR Capital Management had $1.7 million invested in the company at the end of the quarter. Panayotis Takis Sparaggis’s Alkeon Capital Management also made a $1.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Minhua Zhang’s Weld Capital Management, Hoon Kim’s Quantinno Capital, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to Altair Engineering Inc. (NASDAQ:ALTR). These stocks are Retail Properties of America Inc (NYSE:RPAI), Hillenbrand, Inc. (NYSE:HI), Repligen Corporation (NASDAQ:RGEN), and Acadia Healthcare Company Inc (NASDAQ:ACHC). All of these stocks’ market caps match ALTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RPAI | 16 | 206200 | 1 |

| HI | 20 | 49575 | 2 |

| RGEN | 20 | 67468 | -2 |

| ACHC | 19 | 463095 | 1 |

| Average | 18.75 | 196585 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $197 million. That figure was $71 million in ALTR’s case. Hillenbrand, Inc. (NYSE:HI) is the most popular stock in this table. On the other hand Retail Properties of America Inc (NYSE:RPAI) is the least popular one with only 16 bullish hedge fund positions. Altair Engineering Inc. (NASDAQ:ALTR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on ALTR as the stock returned 4.3% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.