We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. That’s a big deal.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

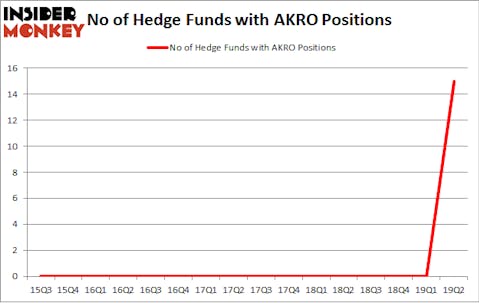

Akero Therapeutics, Inc. (NASDAQ:AKRO) has experienced an increase in hedge fund sentiment lately. AKRO was in 15 hedge funds’ portfolios at the end of June. There were 0 hedge funds in our database with AKRO positions at the end of the previous quarter. Our calculations also showed that AKRO isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are tons of signals stock traders have at their disposal to analyze publicly traded companies. Some of the most under-the-radar signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the top investment managers can outclass the market by a solid amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the key hedge fund action surrounding Akero Therapeutics, Inc. (NASDAQ:AKRO).

How are hedge funds trading Akero Therapeutics, Inc. (NASDAQ:AKRO)?

At Q2’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15 from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in AKRO over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jeremy Green’s Redmile Group has the number one position in Akero Therapeutics, Inc. (NASDAQ:AKRO), worth close to $22.4 million, comprising 0.6% of its total 13F portfolio. The second most bullish fund manager is Cormorant Asset Management, led by Bihua Chen, holding a $14.7 million position; 0.8% of its 13F portfolio is allocated to the stock. Other peers with similar optimism encompass Mark Lampert’s Biotechnology Value Fund / BVF Inc, Lei Zhang’s Hillhouse Capital Management and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management.

Consequently, specific money managers were breaking ground themselves. Redmile Group, managed by Jeremy Green, created the most valuable position in Akero Therapeutics, Inc. (NASDAQ:AKRO). Redmile Group had $22.4 million invested in the company at the end of the quarter. Bihua Chen’s Cormorant Asset Management also initiated a $14.7 million position during the quarter. The following funds were also among the new AKRO investors: Mark Lampert’s Biotechnology Value Fund / BVF Inc, Lei Zhang’s Hillhouse Capital Management, and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Akero Therapeutics, Inc. (NASDAQ:AKRO) but similarly valued. We will take a look at Pennsylvania Real Estate Investment Trust (NYSE:PEI), Century Bancorp, Inc. (NASDAQ:CNBKA), Puma Biotechnology Inc (NASDAQ:PBYI), and UMH Properties, Inc (NYSE:UMH). This group of stocks’ market values are closest to AKRO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PEI | 6 | 10259 | -2 |

| CNBKA | 3 | 14692 | 1 |

| PBYI | 17 | 130423 | -6 |

| UMH | 9 | 13264 | 0 |

| Average | 8.75 | 42160 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $75 million in AKRO’s case. Puma Biotechnology Inc (NASDAQ:PBYI) is the most popular stock in this table. On the other hand Century Bancorp, Inc. (NASDAQ:CNBKA) is the least popular one with only 3 bullish hedge fund positions. Akero Therapeutics, Inc. (NASDAQ:AKRO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on AKRO as the stock returned 18.8% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.