The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 821 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of March 31st, 2020. In this article we are going to take a look at smart money sentiment towards BRF SA (NYSE:BRFS).

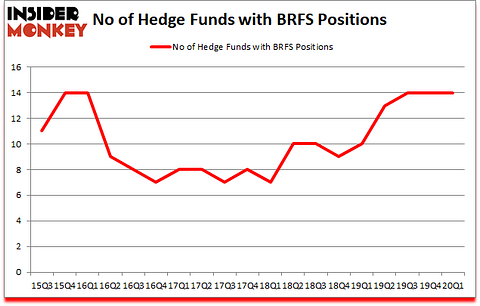

BRF SA (NYSE:BRFS) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 14 hedge funds’ portfolios at the end of the first quarter of 2020. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as John Bean Technologies Corporation (NYSE:JBT), Youdao, Inc. (NYSE:DAO), and Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH) to gather more data points. Our calculations also showed that BRFS isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Kerr Neilson of Platinum Asset Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, we take a look at lists like the 10 PayPal alternatives for international payments to identify emerging companies that are likely to deliver 1000% gains in the coming years. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to analyze the latest hedge fund action regarding BRF SA (NYSE:BRFS).

How have hedgies been trading BRF SA (NYSE:BRFS)?

At the end of the first quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in BRFS a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in BRF SA (NYSE:BRFS) was held by Renaissance Technologies, which reported holding $14.2 million worth of stock at the end of September. It was followed by Platinum Asset Management with a $4.2 million position. Other investors bullish on the company included Oaktree Capital Management, Two Sigma Advisors, and D E Shaw. In terms of the portfolio weights assigned to each position Oaktree Capital Management allocated the biggest weight to BRF SA (NYSE:BRFS), around 0.12% of its 13F portfolio. Platinum Asset Management is also relatively very bullish on the stock, setting aside 0.1 percent of its 13F equity portfolio to BRFS.

Because BRF SA (NYSE:BRFS) has witnessed bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there exists a select few hedgies who were dropping their positions entirely in the first quarter. Interestingly, John Burbank’s Passport Capital sold off the largest investment of the “upper crust” of funds tracked by Insider Monkey, worth an estimated $17.4 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also said goodbye to its stock, about $0.7 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as BRF SA (NYSE:BRFS) but similarly valued. These stocks are John Bean Technologies Corporation (NYSE:JBT), Youdao, Inc. (NYSE:DAO), Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH), and Ternium S.A. (NYSE:TX). All of these stocks’ market caps match BRFS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JBT | 12 | 69622 | -4 |

| DAO | 6 | 183674 | 3 |

| NCLH | 20 | 113661 | -18 |

| TX | 8 | 62086 | -3 |

| Average | 11.5 | 107261 | -5.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $107 million. That figure was $35 million in BRFS’s case. Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH) is the most popular stock in this table. On the other hand Youdao, Inc. (NYSE:DAO) is the least popular one with only 6 bullish hedge fund positions. BRF SA (NYSE:BRFS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th but still beat the market by 16.8 percentage points. Hedge funds were also right about betting on BRFS as the stock returned 43.4% in Q2 (through June 25th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Brf Sa (NYSE:BRFS)

Follow Brf Sa (NYSE:BRFS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.