We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Pool Corporation (NASDAQ:POOL).

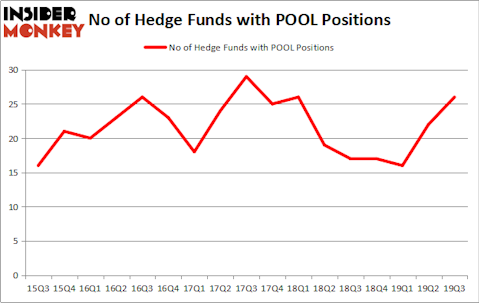

Pool Corporation (NASDAQ:POOL) has seen an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that POOL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most traders, hedge funds are assumed to be unimportant, outdated financial tools of yesteryear. While there are greater than 8000 funds trading today, Our researchers choose to focus on the upper echelon of this group, around 750 funds. These investment experts administer bulk of the hedge fund industry’s total asset base, and by paying attention to their best equity investments, Insider Monkey has found a few investment strategies that have historically outrun the market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Richard Chilton of Chilton Investment Company

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the fresh hedge fund action surrounding Pool Corporation (NASDAQ:POOL).

How are hedge funds trading Pool Corporation (NASDAQ:POOL)?

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from the previous quarter. On the other hand, there were a total of 17 hedge funds with a bullish position in POOL a year ago. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

The largest stake in Pool Corporation (NASDAQ:POOL) was held by Fisher Asset Management, which reported holding $96.1 million worth of stock at the end of September. It was followed by Impax Asset Management with a $80.9 million position. Other investors bullish on the company included GLG Partners, Chilton Investment Company, and Royce & Associates. In terms of the portfolio weights assigned to each position Waratah Capital Advisors allocated the biggest weight to Pool Corporation (NASDAQ:POOL), around 2.04% of its portfolio. Brant Point Investment Management is also relatively very bullish on the stock, dishing out 1.33 percent of its 13F equity portfolio to POOL.

As one would reasonably expect, some big names were leading the bulls’ herd. Waratah Capital Advisors, managed by Brad Dunkley and Blair Levinsky, created the biggest position in Pool Corporation (NASDAQ:POOL). Waratah Capital Advisors had $20.3 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace also initiated a $9.8 million position during the quarter. The following funds were also among the new POOL investors: Renaissance Technologies, Nick Thakore’s Diametric Capital, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks similar to Pool Corporation (NASDAQ:POOL). These stocks are Vedanta Ltd (NYSE:VEDL), Bunge Limited (NYSE:BG), Zayo Group Holdings Inc (NYSE:ZAYO), and Alaska Air Group, Inc. (NYSE:ALK). This group of stocks’ market values match POOL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VEDL | 10 | 55913 | 2 |

| BG | 34 | 579574 | 3 |

| ZAYO | 50 | 1997124 | -9 |

| ALK | 31 | 486037 | 9 |

| Average | 31.25 | 779662 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $780 million. That figure was $402 million in POOL’s case. Zayo Group Holdings Inc (NYSE:ZAYO) is the most popular stock in this table. On the other hand Vedanta Ltd (NYSE:VEDL) is the least popular one with only 10 bullish hedge fund positions. Pool Corporation (NASDAQ:POOL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately POOL wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); POOL investors were disappointed as the stock returned 2.6% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.