“Market conditions are changing. The continued rise in interest rates suggests we are in the early stages of a bond bear market, which could intensify as central banks withdraw liquidity. The receding tide of liquidity will start to reveal more rocks beyond what has been exposed in emerging markets so far, and the value of a value discipline will be in avoiding the biggest capital-destroying rocks. If a rock emerges on the crowded shore of U.S. momentum, it could result in a major liquidity challenge, as momentum is often most intense on the downside as a crowded trade reverses. So investors are facing a large potential trade-off right now: continue to bet on the current dominance of momentum and the S&P 500, or bet on change and take an active value bet in names with attractive value and optionality, but with negative momentum,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Pool Corporation (NASDAQ:POOL).

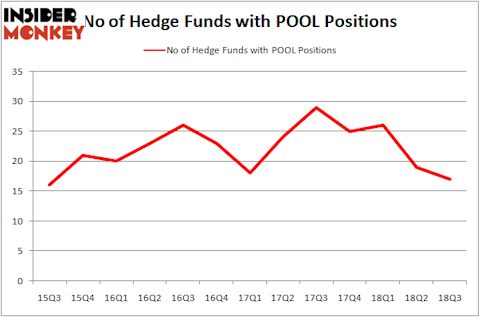

Pool Corporation (NASDAQ:POOL) was in 17 hedge funds’ portfolios at the end of September. POOL has seen a decrease in enthusiasm from smart money of late. There were 19 hedge funds in our database with POOL positions at the end of the previous quarter. Our calculations also showed that POOL isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are many indicators stock market investors can use to assess publicly traded companies. A pair of the most under-the-radar indicators are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can outclass the market by a solid amount (see the details here).

We’re going to take a look at the new hedge fund action encompassing Pool Corporation (NASDAQ:POOL).

How have hedgies been trading Pool Corporation (NASDAQ:POOL)?

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -11% from one quarter earlier. By comparison, 25 hedge funds held shares or bullish call options in POOL heading into this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Fisher Asset Management was the largest shareholder of Pool Corporation (NASDAQ:POOL), with a stake worth $99.2 million reported as of the end of September. Trailing Fisher Asset Management was Impax Asset Management, which amassed a stake valued at $61.5 million. Royce & Associates, GLG Partners, and Waratah Capital Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Pool Corporation (NASDAQ:POOL) has witnessed declining sentiment from hedge fund managers, we can see that there is a sect of hedge funds who were dropping their positions entirely in the third quarter. At the top of the heap, Clint Carlson’s Carlson Capital dropped the largest position of all the hedgies tracked by Insider Monkey, comprising an estimated $9.9 million in stock, and Peter Muller’s PDT Partners was right behind this move, as the fund dropped about $1.4 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to Pool Corporation (NASDAQ:POOL). We will take a look at Texas Pacific Land Trust (NYSE:TPL), MarketAxess Holdings Inc. (NASDAQ:MKTX), AptarGroup, Inc. (NYSE:ATR), and US Foods Holding Corp. (NYSE:USFD). This group of stocks’ market values are closest to POOL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPL | 11 | 1652556 | 1 |

| MKTX | 13 | 149475 | 2 |

| ATR | 13 | 69129 | 2 |

| USFD | 36 | 1176157 | -6 |

| Average | 18.25 | 761829 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $762 million. That figure was $264 million in POOL’s case. US Foods Holding Corp. (NYSE:USFD) is the most popular stock in this table. On the other hand Texas Pacific Land Trust (NYSE:TPL) is the least popular one with only 11 bullish hedge fund positions. Pool Corporation (NASDAQ:POOL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard USFD might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.