As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about Pool Corporation (NASDAQ:POOL) in this article.

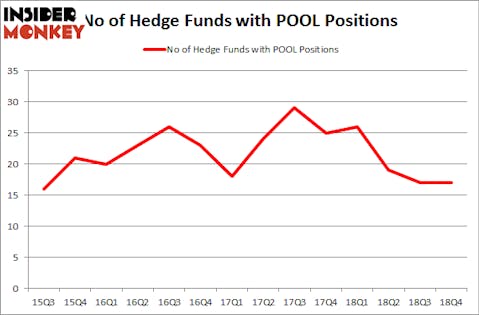

Pool Corporation (NASDAQ:POOL) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 17 hedge funds’ portfolios at the end of the fourth quarter of 2018. At the end of this article we will also compare POOL to other stocks including Vectren Corporation (NYSE:VVC), PRA Health Sciences Inc (NASDAQ:PRAH), and USG Corporation (NYSE:USG) to get a better sense of its popularity.

If you’d ask most investors, hedge funds are assumed to be slow, old investment tools of yesteryear. While there are more than 8000 funds with their doors open today, Our experts hone in on the elite of this club, approximately 750 funds. It is estimated that this group of investors oversee most of the hedge fund industry’s total capital, and by following their inimitable picks, Insider Monkey has revealed several investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to view the fresh hedge fund action surrounding Pool Corporation (NASDAQ:POOL).

Hedge fund activity in Pool Corporation (NASDAQ:POOL)

At the end of the fourth quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 26 hedge funds with a bullish position in POOL a year ago. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Among these funds, Fisher Asset Management held the most valuable stake in Pool Corporation (NASDAQ:POOL), which was worth $87.8 million at the end of the third quarter. On the second spot was Impax Asset Management which amassed $58.3 million worth of shares. Moreover, Royce & Associates, GLG Partners, and Chilton Investment Company were also bullish on Pool Corporation (NASDAQ:POOL), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Pool Corporation (NASDAQ:POOL) has witnessed falling interest from the smart money, it’s easy to see that there lies a certain “tier” of fund managers that elected to cut their positions entirely by the end of the third quarter. Intriguingly, Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors sold off the largest investment of the “upper crust” of funds followed by Insider Monkey, comprising about $16.1 million in stock. Steve Cohen’s fund, Point72 Asset Management, also sold off its stock, about $0.7 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Pool Corporation (NASDAQ:POOL) but similarly valued. We will take a look at Vectren Corporation (NYSE:VVC), PRA Health Sciences Inc (NASDAQ:PRAH), USG Corporation (NYSE:USG), and Hill-Rom Holdings, Inc. (NYSE:HRC). This group of stocks’ market values are closest to POOL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VVC | 23 | 731051 | 4 |

| PRAH | 25 | 297610 | -3 |

| USG | 20 | 2262197 | -1 |

| HRC | 29 | 650301 | 5 |

| Average | 24.25 | 985290 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $985 million. That figure was $242 million in POOL’s case. Hill-Rom Holdings, Inc. (NYSE:HRC) is the most popular stock in this table. On the other hand USG Corporation (NYSE:USG) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Pool Corporation (NASDAQ:POOL) is even less popular than USG. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately POOL wasn’t in this group. Hedge funds that bet on POOL were disappointed as the stock returned 14.6% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.