Does Skyworks Solutions Inc (NASDAQ:SWKS) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

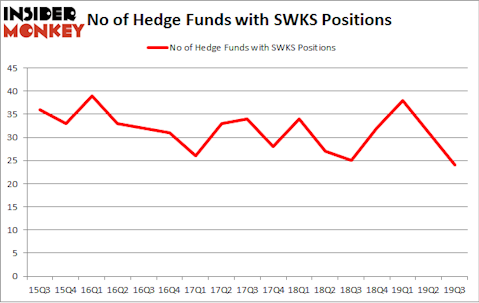

Is Skyworks Solutions Inc (NASDAQ:SWKS) the right pick for your portfolio? Money managers are in a bearish mood. The number of long hedge fund positions were trimmed by 7 recently. Our calculations also showed that SWKS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are viewed as worthless, old financial vehicles of the past. While there are more than 8000 funds trading at the moment, Our researchers choose to focus on the leaders of this club, about 750 funds. Most estimates calculate that this group of people administer the majority of the hedge fund industry’s total capital, and by paying attention to their first-class picks, Insider Monkey has uncovered many investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

David Harding of Winton Capital Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to review the fresh hedge fund action surrounding Skyworks Solutions Inc (NASDAQ:SWKS).

How are hedge funds trading Skyworks Solutions Inc (NASDAQ:SWKS)?

Heading into the fourth quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -23% from the second quarter of 2019. On the other hand, there were a total of 25 hedge funds with a bullish position in SWKS a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the number one position in Skyworks Solutions Inc (NASDAQ:SWKS). AQR Capital Management has a $297.1 million position in the stock, comprising 0.3% of its 13F portfolio. Sitting at the No. 2 spot is Platinum Asset Management, managed by Kerr Neilson, which holds a $202.4 million position; the fund has 4.5% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism comprise Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, David Harding’s Winton Capital Management and Clint Carlson’s Carlson Capital. In terms of the portfolio weights assigned to each position Platinum Asset Management allocated the biggest weight to Skyworks Solutions Inc (NASDAQ:SWKS), around 4.53% of its portfolio. Intrinsic Edge Capital is also relatively very bullish on the stock, dishing out 0.97 percent of its 13F equity portfolio to SWKS.

Since Skyworks Solutions Inc (NASDAQ:SWKS) has experienced declining sentiment from hedge fund managers, it’s easy to see that there were a few fund managers who were dropping their positions entirely last quarter. At the top of the heap, Israel Englander’s Millennium Management said goodbye to the largest stake of the 750 funds tracked by Insider Monkey, totaling close to $15.8 million in stock, and Kevin Cottrell and Chris LaSusa’s KCL Capital was right behind this move, as the fund dumped about $11.6 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest was cut by 7 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Skyworks Solutions Inc (NASDAQ:SWKS) but similarly valued. We will take a look at CenturyLink, Inc. (NYSE:CTL), DexCom, Inc. (NASDAQ:DXCM), Old Dominion Freight Line, Inc. (NASDAQ:ODFL), and NVR, Inc. (NYSE:NVR). All of these stocks’ market caps match SWKS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTL | 28 | 1097755 | 1 |

| DXCM | 33 | 558258 | 3 |

| ODFL | 22 | 140882 | -1 |

| NVR | 36 | 1162559 | 9 |

| Average | 29.75 | 739864 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $740 million. That figure was $691 million in SWKS’s case. NVR, Inc. (NYSE:NVR) is the most popular stock in this table. On the other hand Old Dominion Freight Line, Inc. (NASDAQ:ODFL) is the least popular one with only 22 bullish hedge fund positions. Skyworks Solutions Inc (NASDAQ:SWKS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on SWKS as the stock returned 24% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.