Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 of 2018 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETFs by nearly 10 percentage points during the first 11 months of 2019. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at argenx SE (NASDAQ:ARGX) from the perspective of those elite funds.

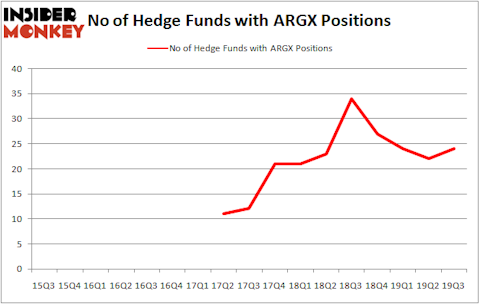

argenx SE (NASDAQ:ARGX) was in 24 hedge funds’ portfolios at the end of the third quarter of 2019. ARGX has experienced an increase in support from the world’s most elite money managers in recent months. There were 22 hedge funds in our database with ARGX holdings at the end of the previous quarter. Our calculations also showed that ARGX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a multitude of metrics stock market investors put to use to assess stocks. A duo of the most innovative metrics are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the elite money managers can outclass the market by a significant margin (see the details here).

Oleg Nodelman of EcoR1 Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the new hedge fund action encompassing argenx SE (NASDAQ:ARGX).

How are hedge funds trading argenx SE (NASDAQ:ARGX)?

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in ARGX over the last 17 quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, Redmile Group was the largest shareholder of argenx SE (NASDAQ:ARGX), with a stake worth $123.1 million reported as of the end of September. Trailing Redmile Group was Baker Bros. Advisors, which amassed a stake valued at $116.2 million. venBio Select Advisor, EcoR1 Capital, and OrbiMed Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position EcoR1 Capital allocated the biggest weight to argenx SE (NASDAQ:ARGX), around 7.64% of its portfolio. Redmile Group is also relatively very bullish on the stock, dishing out 4.12 percent of its 13F equity portfolio to ARGX.

As industrywide interest jumped, some big names have jumped into argenx SE (NASDAQ:ARGX) headfirst. Stevens Capital Management, managed by Matthew Tewksbury, created the largest position in argenx SE (NASDAQ:ARGX). Stevens Capital Management had $0.3 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace also made a $0 million investment in the stock during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as argenx SE (NASDAQ:ARGX) but similarly valued. These stocks are Pure Storage, Inc. (NYSE:PSTG), Graphic Packaging Holding Company (NYSE:GPK), Healthcare Realty Trust Inc (NYSE:HR), and Webster Financial Corporation (NYSE:WBS). This group of stocks’ market valuations match ARGX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PSTG | 32 | 690528 | 9 |

| GPK | 33 | 500405 | 3 |

| HR | 12 | 44639 | 3 |

| WBS | 22 | 337629 | 0 |

| Average | 24.75 | 393300 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $393 million. That figure was $620 million in ARGX’s case. Graphic Packaging Holding Company (NYSE:GPK) is the most popular stock in this table. On the other hand Healthcare Realty Trust Inc (NYSE:HR) is the least popular one with only 12 bullish hedge fund positions. argenx SE (NASDAQ:ARGX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on ARGX as the stock returned 29.9% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.