As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the second quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about AstraZeneca plc (NYSE:AZN).

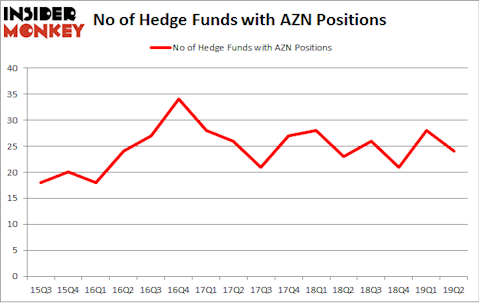

AstraZeneca plc (NYSE:AZN) shareholders have witnessed a decrease in support from the world’s most elite money managers lately. AZN was in 24 hedge funds’ portfolios at the end of June. There were 28 hedge funds in our database with AZN positions at the end of the previous quarter. Our calculations also showed that AZN isn’t among the 30 most popular stocks among hedge funds. Overall hedge fund sentiment towards the stock has been pretty stable over the last 6 quarters.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the latest hedge fund action regarding AstraZeneca plc (NYSE:AZN).

How have hedgies been trading AstraZeneca plc (NYSE:AZN)?

Heading into the third quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards AZN over the last 16 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Fisher’s Fisher Asset Management has the number one position in AstraZeneca plc (NYSE:AZN), worth close to $656.5 million, corresponding to 0.7% of its total 13F portfolio. Coming in second is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $386.6 million position; the fund has 0.9% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish consist of Thomas Steyer’s Farallon Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP and Steve Cohen’s Point72 Asset Management.

Judging by the fact that AstraZeneca plc (NYSE:AZN) has faced falling interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of money managers that elected to cut their full holdings in the second quarter. Interestingly, James Dinan’s York Capital Management dumped the largest position of all the hedgies watched by Insider Monkey, worth close to $57.9 million in stock, and Joseph Samuels’s Islet Management was right behind this move, as the fund dumped about $10 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 4 funds in the second quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as AstraZeneca plc (NYSE:AZN) but similarly valued. These stocks are Texas Instruments Incorporated (NASDAQ:TXN), Rio Tinto Group (NYSE:RIO), The Toronto-Dominion Bank (NYSE:TD), and American Express Company (NYSE:AXP). This group of stocks’ market valuations are similar to AZN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TXN | 43 | 2046831 | 0 |

| RIO | 24 | 1913982 | 2 |

| TD | 18 | 648247 | 0 |

| AXP | 45 | 22025448 | -12 |

| Average | 32.5 | 6658627 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.5 hedge funds with bullish positions and the average amount invested in these stocks was $6659 million. That figure was $1602 million in AZN’s case. American Express Company (NYSE:AXP) is the most popular stock in this table. On the other hand The Toronto-Dominion Bank (NYSE:TD) is the least popular one with only 18 bullish hedge fund positions. AstraZeneca plc (NYSE:AZN) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on AZN as the stock returned 9.1% during the same time frame and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.