You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

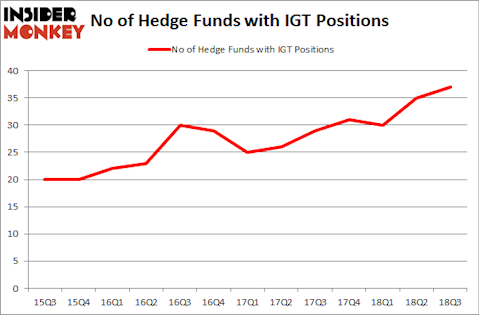

Is International Game Technology PLC (NYSE:IGT) the right investment to pursue these days? Money managers are becoming more confident. The number of bullish hedge fund positions improved by 2 lately. Our calculations also showed that IGT isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most stock holders, hedge funds are seen as slow, outdated investment vehicles of years past. While there are more than 8,000 funds trading at present, We choose to focus on the moguls of this club, around 700 funds. Most estimates calculate that this group of people oversee the majority of all hedge funds’ total asset base, and by watching their finest stock picks, Insider Monkey has unearthed a few investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to analyze the fresh hedge fund action surrounding International Game Technology PLC (NYSE:IGT).

What have hedge funds been doing with International Game Technology PLC (NYSE:IGT)?

At the end of the third quarter, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from one quarter earlier. On the other hand, there were a total of 31 hedge funds with a bullish position in IGT at the beginning of this year. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

More specifically, PAR Capital Management was the largest shareholder of International Game Technology PLC (NYSE:IGT), with a stake worth $159.5 million reported as of the end of September. Trailing PAR Capital Management was Point72 Asset Management, which amassed a stake valued at $152.1 million. Millennium Management, BloombergSen, and Rubric Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key hedge funds have jumped into International Game Technology PLC (NYSE:IGT) headfirst. HG Vora Capital Management, managed by Parag Vora, assembled the most outsized position in International Game Technology PLC (NYSE:IGT). HG Vora Capital Management had $33.6 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also initiated a $19.9 million position during the quarter. The other funds with brand new IGT positions are Mark Kingdon’s Kingdon Capital, Ward Davis and Brian Agnew’s Caerus Global Investors, and Curtis Schenker and Craig Effron’s Scoggin.

Let’s go over hedge fund activity in other stocks similar to International Game Technology PLC (NYSE:IGT). We will take a look at Penske Automotive Group, Inc. (NYSE:PAG), Clean Harbors Inc (NYSE:CLH), Corelogic Inc (NYSE:CLGX), and First Financial Bankshares Inc (NASDAQ:FFIN). This group of stocks’ market caps are similar to IGT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAG | 20 | 94346 | 3 |

| CLH | 18 | 238648 | 5 |

| CLGX | 20 | 378350 | 4 |

| FFIN | 6 | 10038 | 0 |

| Average | 16 | 180346 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $180 million. That figure was $963 million in IGT’s case. Penske Automotive Group, Inc. (NYSE:PAG) is the most popular stock in this table. On the other hand First Financial Bankshares Inc (NASDAQ:FFIN) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks International Game Technology PLC (NYSE:IGT) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.