At Insider Monkey, we pore over the filings of more than 700 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not International Game Technology Ordinary Shares (NYSE:IGT) makes for a good investment right now.

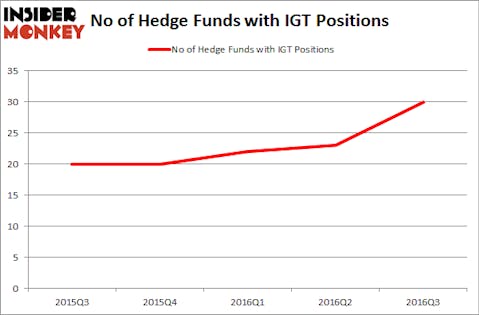

It looks like smart money investors are becoming more hopeful in International Game Technology Ordinary Shares (NYSE:IGT)’s case. More specifically, during the third quarter, the number of investors tracked by Insider Monkey bullish on the stock went up by seven to 30. At the end of this article we will also compare IGT to other stocks including Frontier Communications Corp (NASDAQ:FTR), AptarGroup, Inc. (NYSE:ATR), and Ares Capital Corporation (NASDAQ:ARCC) to get a better sense of its popularity.

Follow International Game Technology (NYSE:IGT)

Follow International Game Technology (NYSE:IGT)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

lassedesignen/Shutterstock.com

Keeping this in mind, let’s take a peek at the fresh action regarding International Game Technology Ordinary Shares (NYSE:IGT).

Hedge fund activity in International Game Technology Ordinary Shares (NYSE:IGT)

At the end of September, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in International Game Technology, up by 30% from the second quarter of 2016. On the other hand, there were a total of 20 hedge funds with a bullish position in IGT at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, BloombergSen, led by Jonathan Bloomberg, holds the most valuable position in International Game Technology Ordinary Shares (NYSE:IGT). BloombergSen has a $158.7 million position in the stock, comprising 15.5% of its 13F portfolio. Coming in second is Bernard Horn’s Polaris Capital Management, which holds a $130.2 million position; the fund has 10.1% of its 13F portfolio invested in the stock. Other peers with similar optimism consist of Cliff Asness’ AQR Capital Management, Paul Reeder and Edward Shapiro’s PAR Capital Management, and Jamie Zimmerman’s Litespeed Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.