We can judge whether The Simply Good Foods Company (NASDAQ:SMPL) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

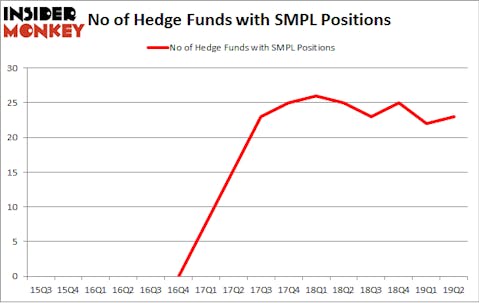

Is The Simply Good Foods Company (NASDAQ:SMPL) an attractive investment now? Money managers are getting more bullish. The number of long hedge fund positions increased by 1 lately. Our calculations also showed that SMPL isn’t among the 30 most popular stocks among hedge funds (view the video below). SMPL was in 23 hedge funds’ portfolios at the end of the second quarter of 2019. There were 22 hedge funds in our database with SMPL holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of tools stock market investors employ to size up their holdings. Two of the most useful tools are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass the broader indices by a superb margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the new hedge fund action regarding The Simply Good Foods Company (NASDAQ:SMPL).

How have hedgies been trading The Simply Good Foods Company (NASDAQ:SMPL)?

At the end of the second quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SMPL over the last 16 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Among these funds, Lomas Capital Management held the most valuable stake in The Simply Good Foods Company (NASDAQ:SMPL), which was worth $50.8 million at the end of the second quarter. On the second spot was Millennium Management which amassed $45.8 million worth of shares. Moreover, Renaissance Technologies, D E Shaw, and Woodson Capital Management were also bullish on The Simply Good Foods Company (NASDAQ:SMPL), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, some big names have jumped into The Simply Good Foods Company (NASDAQ:SMPL) headfirst. Coatue Management, managed by Philippe Laffont, assembled the most outsized position in The Simply Good Foods Company (NASDAQ:SMPL). Coatue Management had $1.3 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $0.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Minhua Zhang’s Weld Capital Management, Mike Vranos’s Ellington, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as The Simply Good Foods Company (NASDAQ:SMPL) but similarly valued. We will take a look at Renasant Corporation (NASDAQ:RNST), DiamondRock Hospitality Company (NYSE:DRH), WesBanco, Inc. (NASDAQ:WSBC), and Insight Enterprises, Inc. (NASDAQ:NSIT). All of these stocks’ market caps match SMPL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RNST | 11 | 30890 | -5 |

| DRH | 17 | 177431 | 4 |

| WSBC | 10 | 73062 | 2 |

| NSIT | 14 | 121508 | -3 |

| Average | 13 | 100723 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $101 million. That figure was $244 million in SMPL’s case. DiamondRock Hospitality Company (NYSE:DRH) is the most popular stock in this table. On the other hand WesBanco, Inc. (NASDAQ:WSBC) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks The Simply Good Foods Company (NASDAQ:SMPL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on SMPL as the stock returned 20.4% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.